Australian stocks are known for their high dividend yields. Aussie firms tend to stable and growing dividends and investors also benefit from franking credits.

Dividend payments have been consistent over the long-term when compared to stock price appreciation according to an article by Dr Shane Oliver at AMP Capital.

From the article:

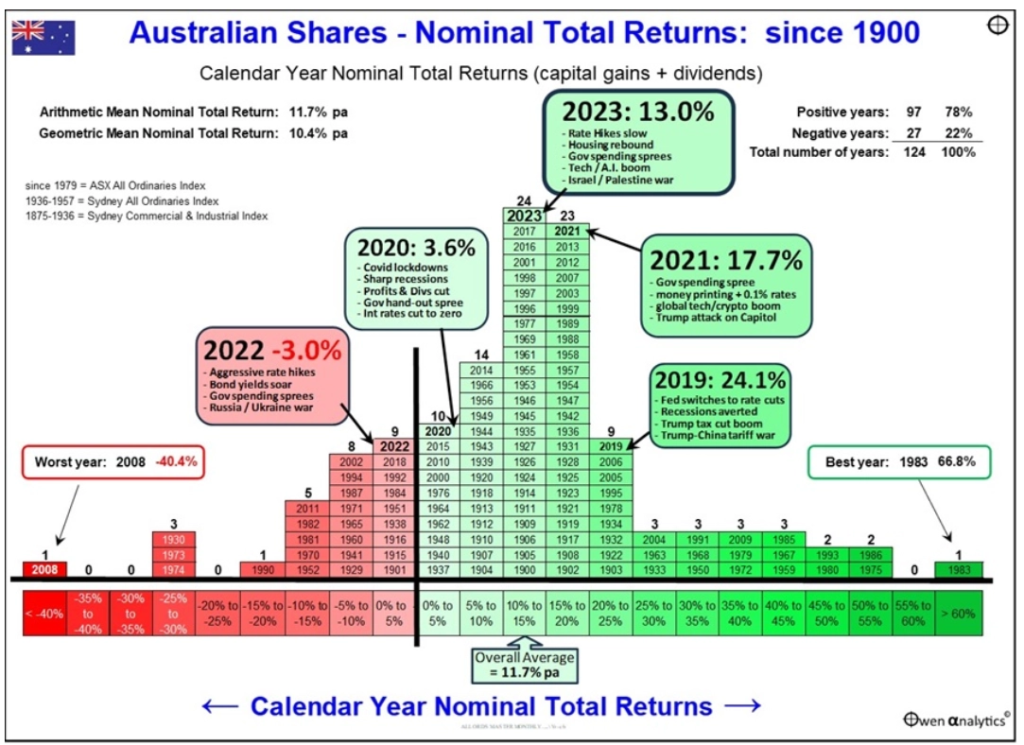

Chart #4 A bird in the hand is worth two in the bush

A high and sustainable starting point yield provides some security during volatile times. Since 1900, dividends (prior to allowing for franking credits) have provided just over half of the 11.8% average annual return from Australian shares and as can be seen in the next chart their contribution has been stable in contrast to the capital value of shares.

Source: Global Financial Data, Bloomberg, AMP Capital

Dividends are relatively smooth over time because most companies hate having to cut them as they know it annoys shareholders so they prefer to keep them sustainable.

Key message: a high and sustainable income yield for an investment provides some security during volatile times. It’s a bit like a down payment on future returns.

Source: Five great charts on investing for income (or cash flow), AMP Capital