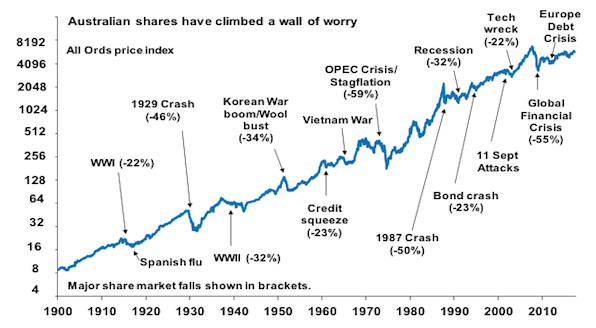

In an article yesterday we looked at how Australian stocks beat cash and bond since 1900. During this period there we many major political and economic events that shook Australia and the world. In general, investors have always something to worry about. For example, today it is North Korea. Just a while ago it was the US election drama.Before that many years of European debt crisis drama and so forth.

Despite multiple major events since 1900 Australian stocks continued to move upward as shown in the All Ordinaries share price index below:

Click to enlarge

Source: Five great charts on investing, AMP Capital

For investors, there is always something to worry about. In the past stocks have overcome the wall of worry to earn higher returns than cash and bonds.

The key takeaway is that investors cannot wait for an ideal environment for investing in the equity market. There will always be some negative events happening – whether it is fluctuating oil prices, wars or simply threat of wars, recessions, etc. Instead of worrying too much about events that are beyond their control investors should focus on the long-term goal and accumulate assets at cheaper prices when the opportunity presents itself.