U.S. stocks have outperformed international stocks in the past few years. Foreign stocks look attractive at current levels while their American peers look expensive. According to an article by Jurrien Timmer at Fidelity, since the Global Financial Crisis peak in March 2007 thru April 2017 the S&P 500 has returned 282% in total returns compared to 136% and 130% for international developed and emerging market stocks.

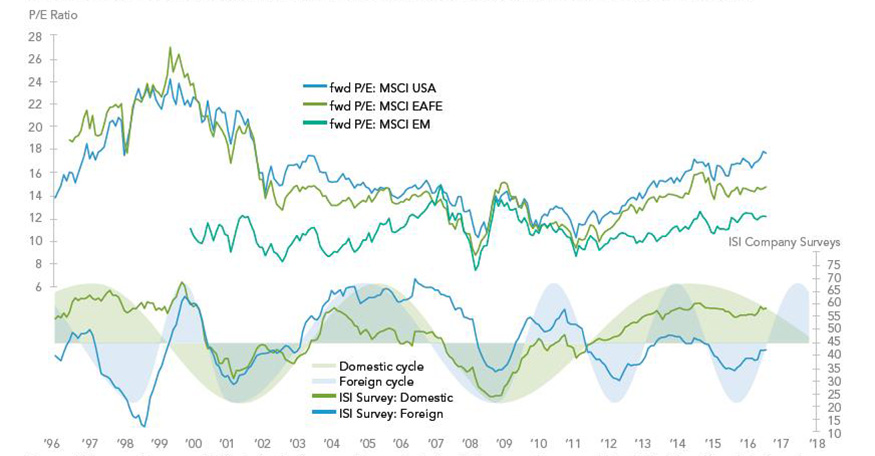

Most recently the MSCI US Index had a forward P/E ratio of 17.7 while the MSCI EAFE Index (for international developed market) and MSCI EM Index had ratios of 14.8 and 12.2. So investors looking to diversify their holdings may want to consider adding high-quality foreign stocks in a phased manner.

Click to enlarge

Source: Stock market check-in: Good and not-as-good news, Fidelity