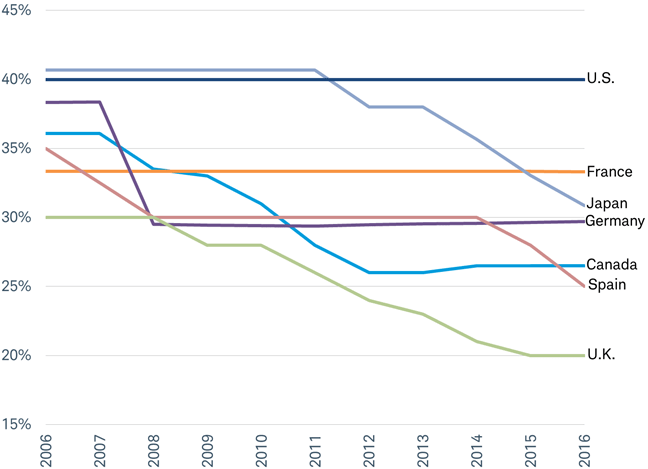

The US corporate tax rate has stayed at the 40% rate for many years now. But in many developed countries the tax rate has been been declining in the past few years as shown in the chart below:

Click to tn enlarge

Source: Charles Schwab, KPMG data as of 4/26/2017.

The U.S. statutory corporate income tax rate is approximately 40%. While the marginal federal corporate income tax rate on the highest income bracket of corporations is 35%, state and local governments also impose income taxes averaging approximately 7.5%. Since corporations may deduct its state and local income tax expense when computing its federal taxable income, this generally results in a net effective rate of approximately 40%.Corporate tax rate displayed is the combination of federal and local taxes and surcharges in each country to allow for accurate comparisons across borders.

Source: What the Coming Tax Cuts Mean for the Stock Market, Schwab