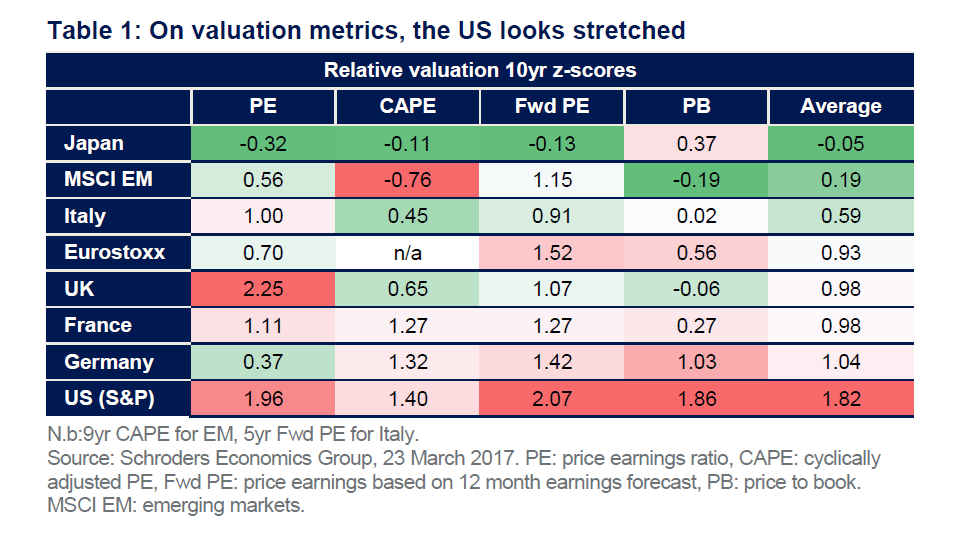

The U.S. equity market has performed well in recent months especially since the election in November. The S&P 500 is up by over 5.50% year-to-date on price only basis. The solid performance of US stocks has pushed valuations to high levels. When compared to other markets, US valuations look stretched according to a report by Schroders. From the report:

Markets are clearly putting a lot of faith in President Trump’s ability to deliver on his promises. Although valuation is not a good guide to near term performance, it does become a factor on longer time horizons. From our analysis, the US is trading well above normalised valuations for Price Earnings (historic, expected and cyclically adjusted PE) and on price-to-book. Easy money and low bond yields play a significant role in sustaining these valuations, so higher inflation which threatens to change Fed policy will be critical to the market outlook.

Source: Schroders Economic and Strategy Viewpoint, April 2017, Schroders

The key takeaway is that investors must not be complacent when markets continue to rise. U.S. stocks could lag foreign stocks this year. Many of the developed European markets are ahead of US markets so far this year. So investors may want to consider diversifying their portfolio across markets and asset classes.