The benchmark index of the Indian equity market is the BSE Sensex Index. Though the Sensex is main index for Indian equities it is not the ideal index for many reasons. For example, emerging market investors such as those investing in Indian stocks invest to gain from the growth in the Indian economy.However investing in an ETF or a fund that tracks the performance of the Sensex is not the best way to capture the growth potential.

Simply put, Sensex is not the right representation of the Indian market.

Four flaws of the Senses index are discussed below:

- Index composition methodology: The Sensex constituents are selected based on the free float market capitalization Methodology which means liquidity and market cap is important to gain entry into the index. Other factors such as profitability or long-term growth which truly impact the performance of a stock are not considered. So more popular and widely traded stocks are part of the index simply because they have momentum and high trading levels every day.

- Price Return Index: The Sensex is not a total-return index such as Germany’s DAX. When considering an investment especially over the long-term dividends reinvested must be included in the return calculation.

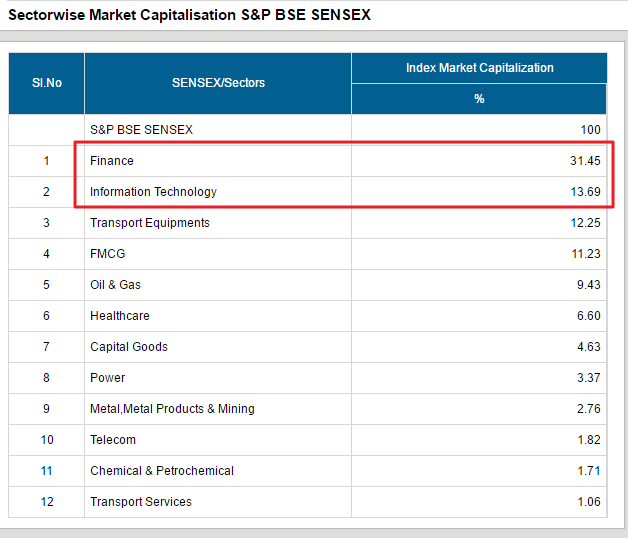

- Sector Composition: About 45% of the Sensex is allocated to finance and IT. This type of high concentration in just two sectors is not optimal. Sensex Composition by Sector :

Source: BSE India

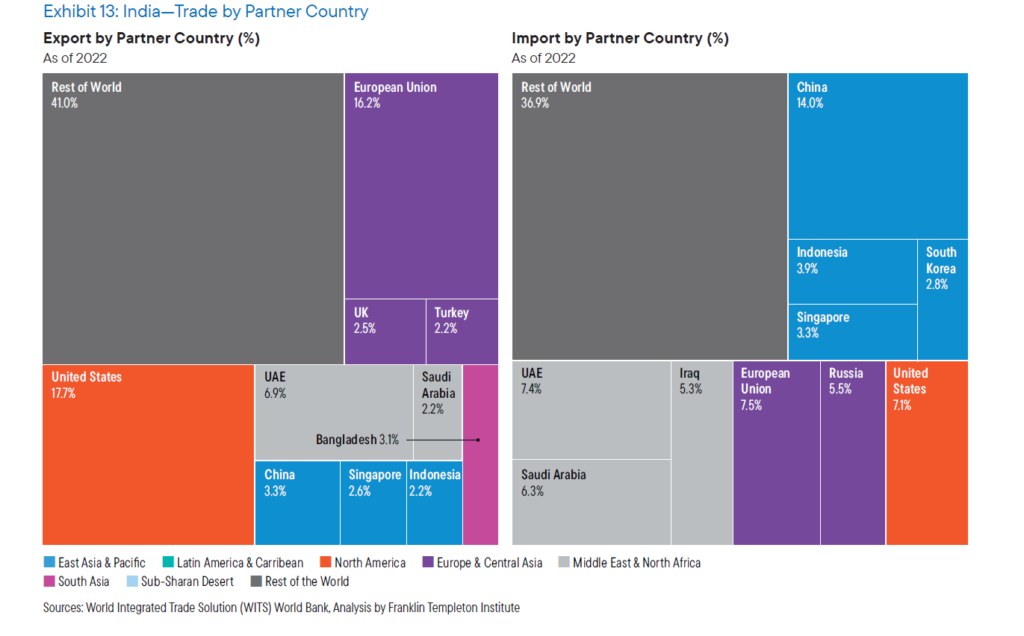

4.High Reliance on Foreign Markets: Many constituents in the Sensex derive a substantial portion of their revenue from foreign countries.This makes them dependent on the state of the overseas economies then India. For instance, IT outsourcers such as Infosys(INFY), Wipro(WIT) and TCS are heavily reliant on foreign companies for their earnings. So investing in their stocks does not mean one is betting on the growth of Indian middle class.Similarly Tata Steel and Tata Motors (TTM) have large overseas operations which impact their performance.

From an investment standpoint, it is important to research and pick individual stocks in emerging markets instead of simply going with an index tracker. Like with the Sensex example, an index may not serve the purpose of an investor looking to gain exposure and profit from the vast growth opportunities in those markets.

Related ETFs:

- WisdomTree India Earnings ETF (EPI)

- iShares S&P India Nifty 50 Index ETF (INDY)

- PowerShares India ETF (PIN)

Disclosure: No Positions