Valuation is important when investing in equities. Investing in stocks when valuations are cheap not only offers some downside protection but also juices the return when markets soar.

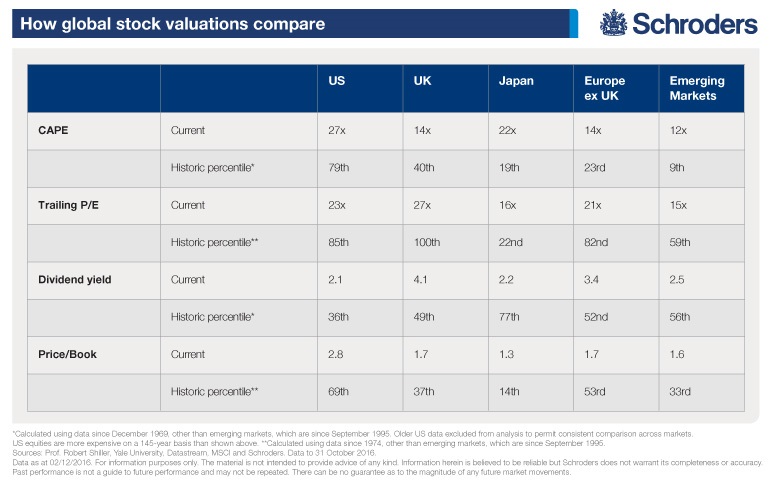

The table below shows the valuations of major equity markets today based on four metrics:

Click to enlarge

Source: How low rates affect stockmarket returns, Schroders

The lower the P/E ratio the better. The sameee goes ffor CAPE or cyclically-adjusted price-to-earnings ratio and price/book ratio.

Higher Dividend yields are better than lower yields.

Based on the CAPE ratio, the US market is expensive. The value of 79 shows that the market has been cheaper 79% of the time than it is today.

The US has the lowest dividend yield at 2.1% while the UK has the highest yield. The US yield is lower than even emerging markets yield.