The coal industry in the US has been on a decline for many years. With hundreds of miners closures thousands of mining jobs have disappeared. Just a few years ago some of the coal mining firms filed for bankruptcy as the demand for coal plunged.

President-elect Donald Trump has promised to revive the coal industry and in the process bring back thousands of those lost mining jobs. So many poor former miners in places like the Appalachia such as West Virginia have given their vote to Mr.Trump. Below is one of the photos from a rally in Wilkes-Barre in Pennsylvania:

Click to enlarge

To fulfill this promise Trump’s policies have to overcome a multitude of challenges facing the industry. To begin with the demand for US coal has declined because most utilities have shutdown coal burning power plants and switched to cheaper options like natural gas. Hence in order to first create demand massive capital is needed for utilities to re-open those coal power plants. Until that happens mines are not going to open simply to give jobs to miners.

From a recent article in the WSJ:

Donald Trump campaigned on a promise to resurrect the ailing U.S. coal industry and put miners back to work. Delivering on that vow could prove nearly impossible.

Electric utilities that buy more than 95% of the coal mined in America have already retired hundreds of their coal-burning power plants from Colorado to Connecticut—amounting to about a third of the total capacity—and have plans to mothball even more.

While in Appalachia earlier this year, Mr. Trump pledged to “bring the coal industry back, 100%” by rolling back environmental regulations. But coal’s biggest problem is that it is no longer the cheapest fossil fuel around. It is being displaced by natural gas.

American Electric Power Co. of Columbus, Ohio, one of the nation’s biggest utility companies, has sold or retired half its fleet of coal-burning power plants in recent years. No matter who occupies the White House, “it’s not coming back,” said Nick Akins, AEP’s chief executive.

Even if Mr. Trump makes good on his campaign promise to relax or repeal pending limits on carbon emissions, it won’t be enough to restore coal’s market share. “We’re moving to a cleaner-energy economy and we’re still getting pressure from investors to reduce carbon emissions,” Mr. Akins said. “I don’t see that changing.”

Source: Cheap Gas Tests Trump’s Promise to Revive Coal by Rebecca Smith, WSJ, Nov 13, 2016

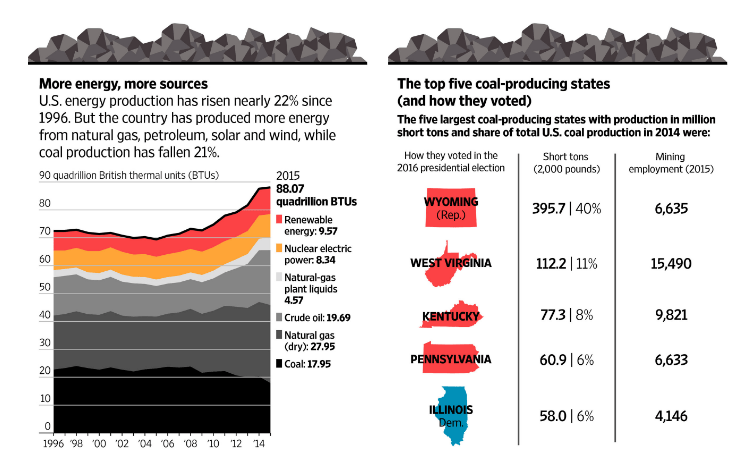

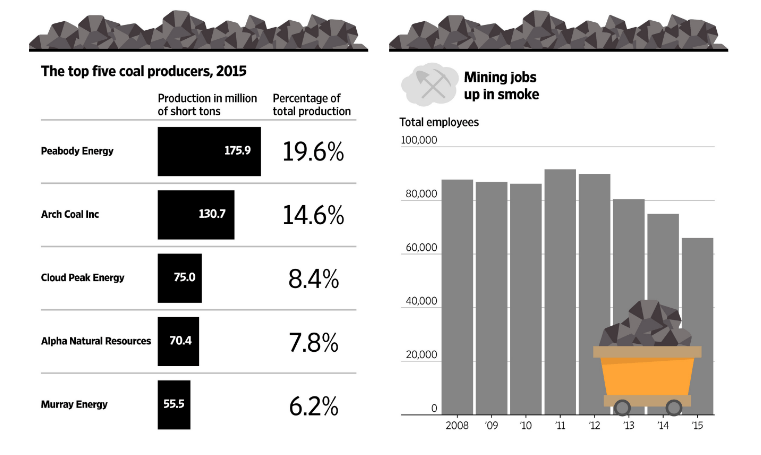

Below is an infographic showing the current state of the US coal industry:

Click to enlarge

Source: What Shape Is U.S. Coal In?, WSJ

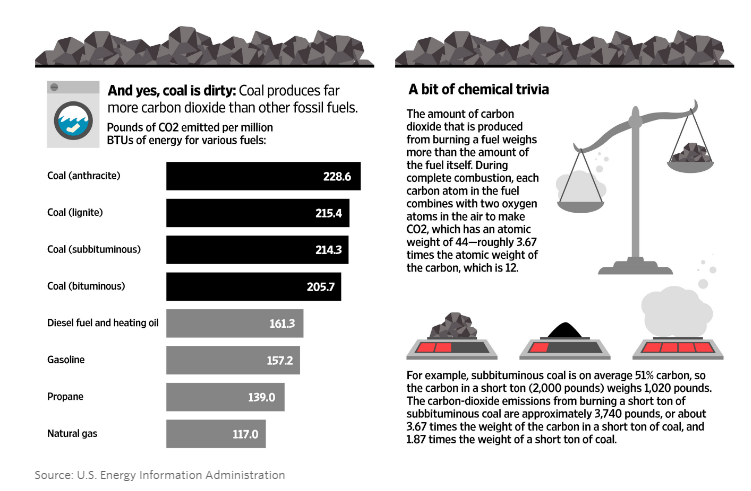

Another important factor is that coal as a source of energy decreased from 49% from 2006 to 33% in 2015. In addition to better and cheaper alternative fuel sources, utilities also face stiff opposition to operating highly polluting coal power plants. So even if those plants are brought back to service, the society’s perception on coal has to change. This is the most difficult of all the challenges.

Click to enlarge

Source: Is Nuclear Power Vital to Hitting CO2 Emissions Targets?, WSJ

The top five coal producers are: Peabody Energy Corporation which trades on the OTC market under the ticker (BTUUQ), Arch Coal, Inc (ARCH), Cloud Peak Energy Inc (CLD), Alpha Natural Resources, Inc (ANR) and Murray Energy. The complete list of coal stocks on the NYSE can be found here.

It remains to be seen if the US coal industry recovers with Trump in office and if the miners that voted for him are able to get their mining jobs back.

Disclosure: No Positions

Readers may also want to checkout: