Stocks in the consumer staples sector have elevated P/E ratios today relative to the market. This is because investors looking for safety and reliable income stream have piled into these stocks over the past few years. Market volatility and ultra-low interest rates only added more fuel to the solid rise of consumer staples stocks. Companies in the sector have rewarded investors year over year with decent dividend growth. However such raises may be unsustainable in the future according to David Jane of Milton Asset Management of UK.

From a recent article at Citywire, UK:

As the table below shows, over the past five years these companies have delivered nearly 10% annual dividend growth.

That looked impressive, said Jane, but had not been driven by rising sales in emerging markets, as many investors believed, because sales growth has been near zero for most of the groups.

Nor had higher dividends been driven by improved profitability, as gross profits (earnings before interest, tax, depreciation and amortisation or ebitada) had grown less than 2% a year.

‘What has been happening is debt has been growing to fund acquisitions and share buybacks, while interest costs have been falling as rates go ever lower,’ said Jane.

‘In fact, debt for the group has grown at over 8% per annum while shares outstanding have fallen and hence, earnings per share have been growing rapidly.’

He added: ‘So, the dividend growth we have seen has largely been driven by financial engineering not a fundamentally attractive business model.’

Consumer group debts have risen with dividends

Company Dividend yield % Dividend growth (5yr) % Sales growth % Gross profits (ebitda) growth (5yr) % Debt growth (5yr) % Debt / /Ebitda Coca-Cola (KO.N) 3.22 8.37 -1.92 -1.97 13.55 2.22 Procter & Gamble (PG.N) 0.03 5.76 -4.88 -3.63 -0.90 1.04 Diageo (DGE) 2.91 7.94 1.79 5.24 4.33 2.68 Altria Group (MO.N) 3.70 8.26 4.21 12.64 1.16 1.35 British American Tobacco (BATS) 3.44 5.53 -2.01 -3.54 10.65 3.71 SABMiller (SAB) 2.35 12.52 -0.76 -1.88 6.77 2.26 Anheuser-Busch (ABI.BR) 3.10 34.69 1.58 0.81 1.96 2.89 Philip Morris (PM.N) 4.16 9.77 -4.19 -5.80 11.53 2.42 Pepsico (PEP.N) 2.86 7.90 -1.72 0.63 5.98 2.09 Reynolds American (RAI.N) 3.75 9.80 7.89 18.65 33.59 1.23 Unilever (ULVR) 0.03 5.36 3.15 3.23 9.89 1.40 Imperial Brands (IMB) 4.03 10.51 -1.60 0.61 6.53 4.33 Colgate-Palmolive (CL.N) 2.16 6.77 -1.61 -0.34 13.93 1.69 Reckitt Benckiser (RB) 2.00 4.13 0.04 -5.63 -1.75 0.79 Heineken (HEIN.AS) 1.70 11.52 3.89 7.23 7.43 2.69 Average 3.25 9.77 0.44 1.84 8.41 2.14 Source: Miton Group

Source: Why ‘expensive defensives’ are running out of road, CityWire UK, Sept 26, 2016

Caution is warranted with picking up consumer staples at current levels. Instead of simply buying these companies for the dividend yield and dividend growth, investors should aim for total return over many years. So investors can wait to add when prices decline. Buying even at 10% lower rate would generate higher total returns if held for the long-term.

Another report titled The Elevated Risks of Safe Stocks by Charles Roth at Thornburg Investment Management also discussed about expensive defensives. From the report:

Traditionally safe, dividend-paying stocks have attracted tremendous investor inflows, raising their share prices and valuation multiples to levels that aren’t supported by earnings growth. The risks of a correction in the “expensive defensives” are running increasingly high, especially as the specter of benchmark interest rate hikes grows.

Executive Summary

• Unprecedented monetary easing and asset purchases by major central banks have pushed yield-seeking investors into dividend-paying stocks, driving up their valuations.

• Earnings growth in the defensive sectors hasn’t supported the expansion in their valuation multiples. The technical flows have been reinforced by the predominant capitalization weighting model in passive investing, which at its essence becomes a momentum trade.

• Risks of a correction are growing, particularly in the U.S., where defensive stocks could be hit if the U.S. Federal Reserve hikes rates sooner than later, as some Fed officials are publicly advocating.

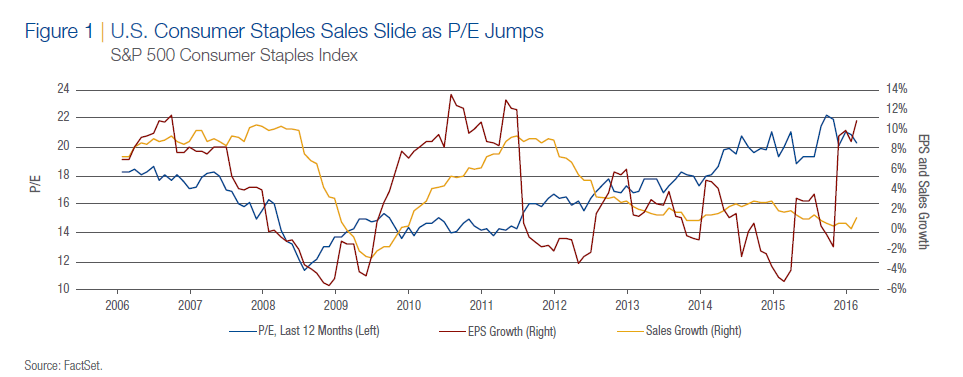

In the US sales are down for consumer staples companies but the P/E continues to grow higher.

Click to enlarge

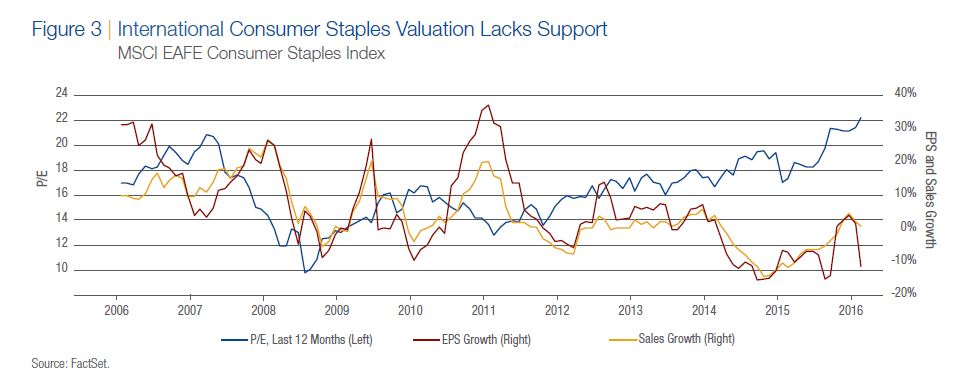

Similar situation exists with international consumer staples also.

Source: The Elevated Risks of Safe Stocks by Charles Roth, Thornburg Investment Management, Sept 2016

Disclosure: Long Reckitt Benckiser (RBGLY)