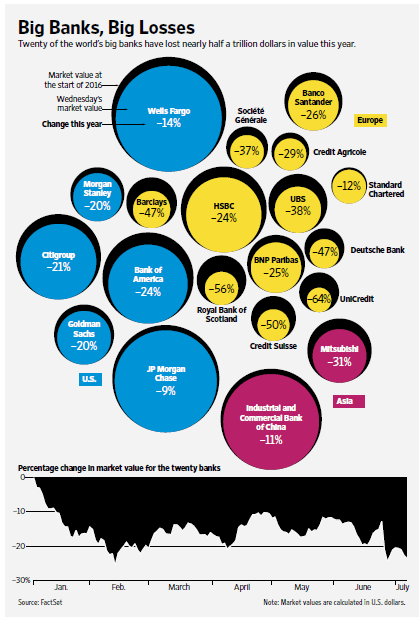

Some of the major European banks have seen their market values decline substantially this year. The STOXX® Europe 600 Banks Index is down about 33% year-to-date in Euro price terms. A few individual banks have lost much more. The following graphic from a recent journal article shows the serious damage to market capitalization of the world’s top 20 banks:

Click to enlarge

Note: Data shown above is as of July 6, 2016.

Source: Bank Market Values Crumple, WSJ, July 7, 2016

From the article:

The biggest market-value losers, in dollar terms, so far this year: Italy’s UniCredit has lost nearly two-thirds of its value; Royal Bank of Scotland has fallen around 56%; and Credit Suisse, Deutsche Bank and Barclays have all about halved.

Compared to European banks,US bank stocks are down by about 12% YTD as measured by the KBW Bank Index.

Among the foreign banks trading on the US markets, the top five with the worst returns YTD are:

- Credit Suisse (CS): -51%

- Royal Bank of Scotland (RBS): -50%

- Lloyds Banking Group (LYG): -37%

- Mitsubishi UFJ Financial (MTU): -30%

- Mizuho Financial (MFG): -30%

The top five banks with the best returns YTD are: Banco Bradesco(BBD), Itau Unibanco(ITUB), Banco Santander Brasil(BSBR) of Brazil, Banco Macro(BMA) of Argentina and BanColombia(CIB) of Colombia. All these banks are up 29% to 83%.

Source: BNY Mellon

Disclosure: Long CIB, BBD and ITUB