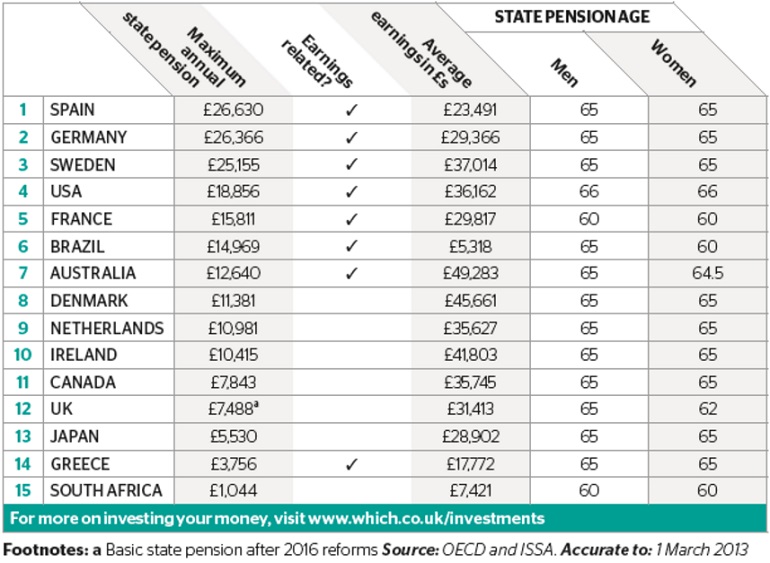

Most developed countries offer a decent pension to their retired citizens, However the annual amount paid out to retirees varies from one country to another. In addition, the retirement age to qualify for a state pension also differs slightly between countries.

The following table shows the maximum annual state pension and the state retirement age for select countries:

Click to enlarge

Source: Are investors too reliant on the state?, Schroders

Among the developed countries, France has the lowest retirement age. This is not surprising since the country is a nanny state with the French expecting the state to take care of them from cradle to grave. Hence the current state proposals to reform labor are met with protests across the country causing chaos to millions to locals and tourists alike.

In the US, the retirement age to receive state pension is 66. Despite the myth about most Americans not trusting the state and worship of free market ideologies, the majority of them depend on the state pension after their retirement for basic survival. The high dependency of Americans on the state is because private source of funds for retirement like 401Ks, savings, company-paid pensions, investments, etc. are not available or dependable for retirees. Since social security is guaranteed and one cannot lose it like with stocks and other asset types, retirees depend on Uncle Sam more than any other sources.