The Global Financial Crisis (GFC) occurred just a few years ago. One of the reasons for that crisis was American consumers piling up excessive debt. For a short time after the crisis, the personal savings ratio started rising. However Americans are back to old habits again as they gorge on debt like there is no tomorrow. As the US is a consumption-based economy when consumers tighten their wallets the economy suffers. Much of the current rising consumption is fueled by debt as opposed to funded with income. With lending standards loosened again US consumers are willing taking on more debt even while their wages have stagnated for years. For most workers, real wages have been stagnant for years especially since the dot-com crash of 2000. But functional illiteracy with financial matters and high-octane gimmicks by marketers have made workers accumulate additional debt considering stagnant wages, pathetic quality of jobs being created, destroyed retirement savings, soaring taxes, etc.

From an article in the journal article discussing rising debt levels:

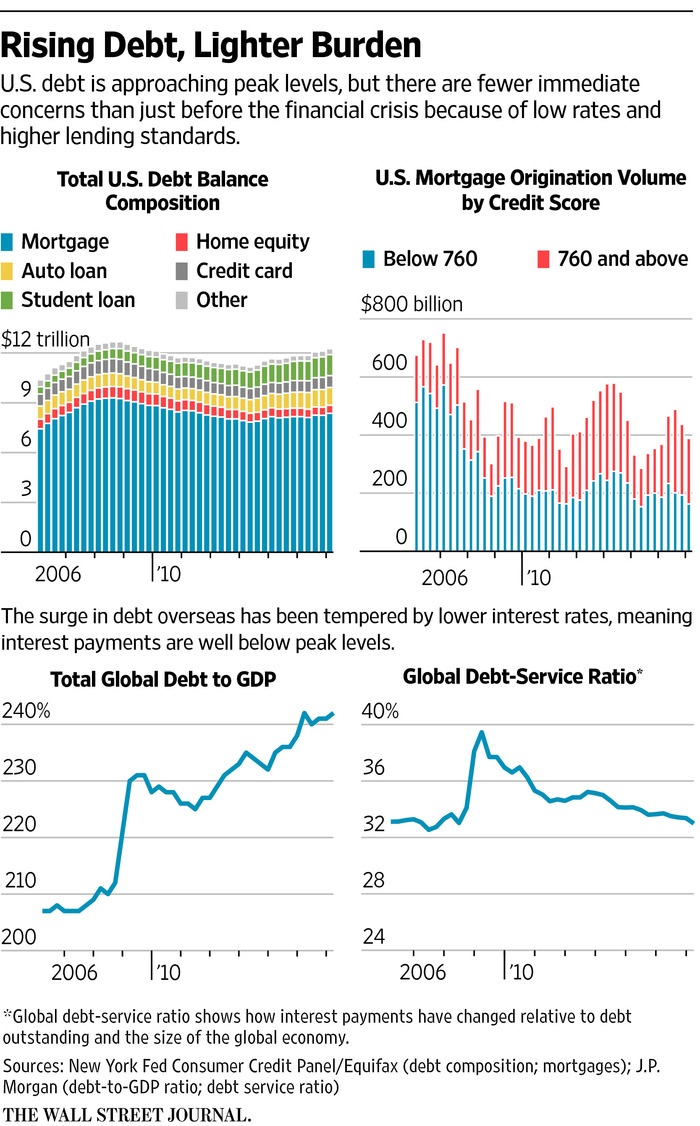

If current trends persist through the end of the year, U.S. households will owe as much as they did at the peak of borrowing in 2008.

Global debt has already topped 2008 levels and keeps rising. That’s pretty astonishing so soon after debt-driven crises in the U.S. and Europe and endless worries about too much borrowing in Japan, China and emerging markets.

But for all the hand-wringing, a near-term debt crisis is unlikely. Lower interest rates mean debt payments are far lower than they were before the crisis. In the U.S., household debt compared with the overall economy is way down. And overseas, loans can easily be rolled over.

Yet even with low rates, the cycle of borrowing and rolling over loans has a cost. People, governments and businesses spend now instead of later, likely reducing future growth. The cycle also allows borrowing to go on for years, which can be good—allowing reform to take hold—or not, allowing bad policies go on almost indefinitely.

U.S. households owed $12.25 trillion at the end of the first quarter, up 1.1% from the end of 2015, according to the Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit, released Tuesday. If the first quarter repeats itself through the end of the year, U.S. household debt will approach its peak of $12.68 trillion, which it hit in the third quarter of 2008.

Source: Trillions in Debt—but for Now, No Reason to Worry, WSJ, May 25, 2016

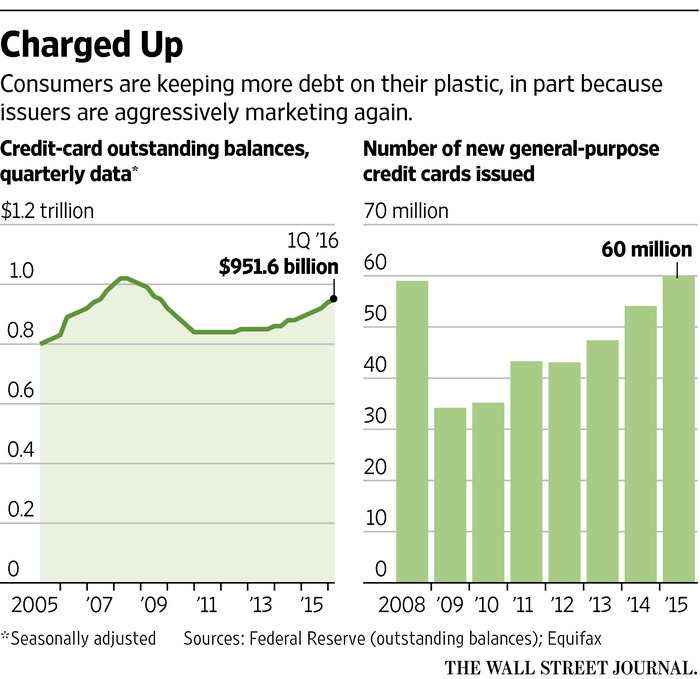

One of the major source of the debt binge by Americans is the small plastic card called as the credit card or more correctly the debt card. Here is a chart shows the growing debt mountain in this category of debt:

Click to enlarge

Source: Balance Due: Credit-Card Debt Nears $1 Trillion as Banks Push Plastic, WSJ, May 20, 2016

According to the above article, the total outstanding balances in credit card debt is poised to hit $1.0 Trillion this year. That would be close enough to the $1.02 Trillion reached before the GFC in 2008.

The soaring debt levels at the consumer level is not good for the economy as a while. Since wages are not rising and expenses are increasing exponentially for middle class and poor Americans, another crisis can be expect to occur in the future unless changes happen that can support the current high standard of living in this country.