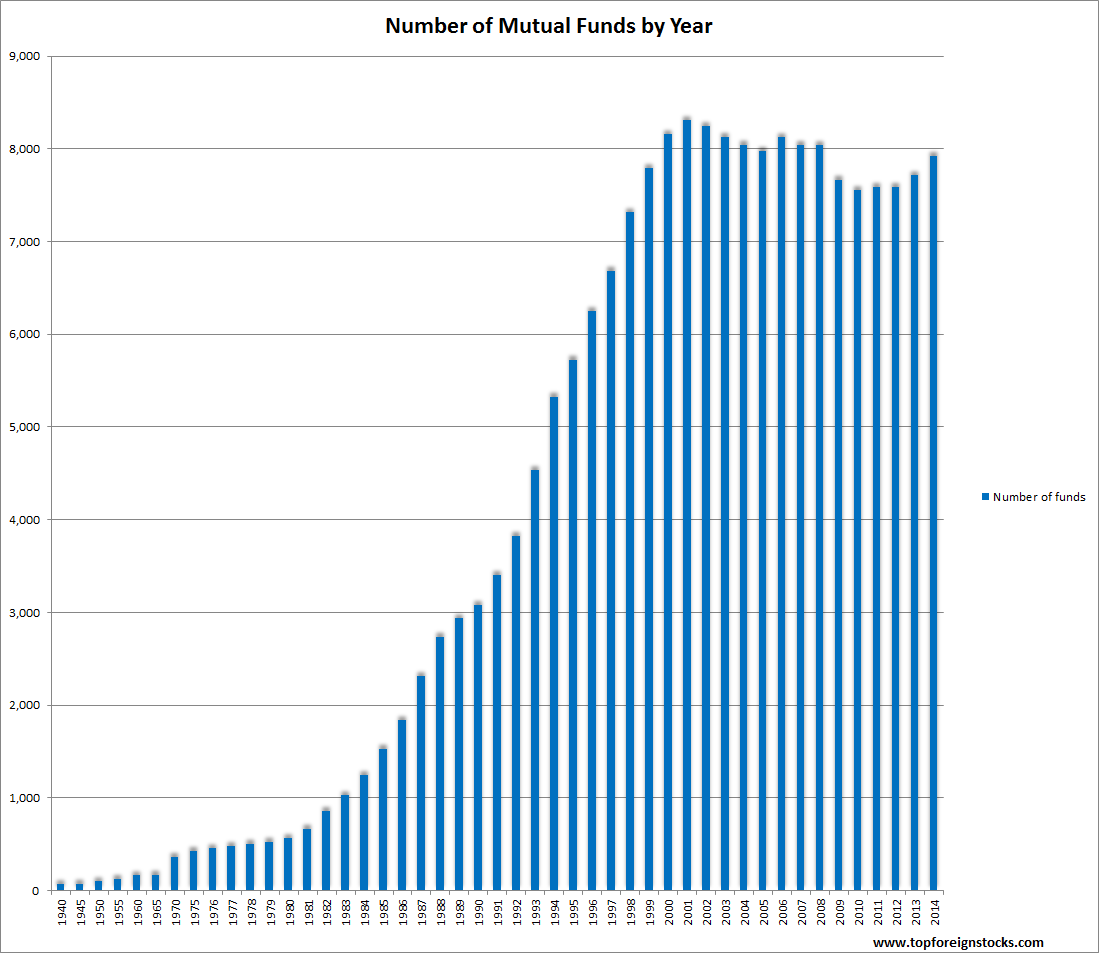

The mutual funds industry in the US is a multi-trillion dollar industry.At the end of 2014, the industry managed assets of about $16.0 Trillion up from just over $1.0 Trillion in 1990. The growth in assets under management over the years has also led to a fierce competition with a multitude of players entering the market. According to the latest full year data available from Investment Company Institute the total number of mutual funds stood at 7,923 at year-end 2014.

The following chart shows the growth in the number of mutual funds by year:

Click to enlarge

Note: Data for funds that invest primarily in other mutual funds were excluded from the series.

Source: Investment Company Institute

The growth of the mutual funds business since 1980s is astounding. As the above chart shows, year after year the number of funds consistently increased only dipping slightly after the dot-com crash of 2000 and the global financial crisis of 2008-09. Since the most recent crisis, the number of funds is on an uptrend again.

The number of funds available on the market for investors has increased due to many factors such as the introduction of 401-k type retirement plans, growth in technology, change in investors’ risk appetite, highly successful marketing tactics by the industry, etc. For instance, with a 401-k retirement plan, up until recently most employers offer only mutual funds to participants. Hence employees had no choice but to select one of the handful of funds presented to them. This indirectly “forced” workers in a fund whether they liked it or not. As the number of participants grew each year billions of dollars were channeled to fund companies each month with automatic deductions from employee’s payroll.

As investors poured money into the thousands of mutual funds on the market, the industry created many classes of funds to cater to various types of investors. These classes of funds differ based on many factors like front-end fees charged, back-end fees charged, contingent-deferred sales charge, with sales charges, without sales charges, amount of capital invested by investors, retail investor, institutional investor, etc.

Slicing and dicing the number of limited stocks listed on the markets, the industry had created over 24,200 fund classes for over 7,900 funds. So on an average each fund has three types of fund classes. This 24,200 figure is many times more than the actual number of listed companies on the US market. To put this number into perspective, the total number of US companies traded on the US exchanges at the of end 2014 was just 5,283. So the industry has flooded the market with funds equal to nearly five times the number of companies listed.

Whether the huge number of available funds and the fund class types is beneficial to an investor or the fund companies is open for debate and is beyond the scope of this post.

Download Data:

- The Number of US Mutual Funds by Year (in Excel format)