In the U.S. the Social Security program run by the Federal Government is one of the most successful programs in helping seniors in retirement. As a state run program it provides a safe, consistent and dependable benefit to seniors when they need it most. Private retirement plans such as the 401-Ks that are a failure for most American workers. Years ago I read a great book titled “The Great 401 (k) Hoax: Why Your Family’s Financial Security Is At Risk, And What You Can Do About It” that was very informative. That aptly book discussed in details the various flaws with this retirement plan that is now THE plan for saving for retirement for most workers.

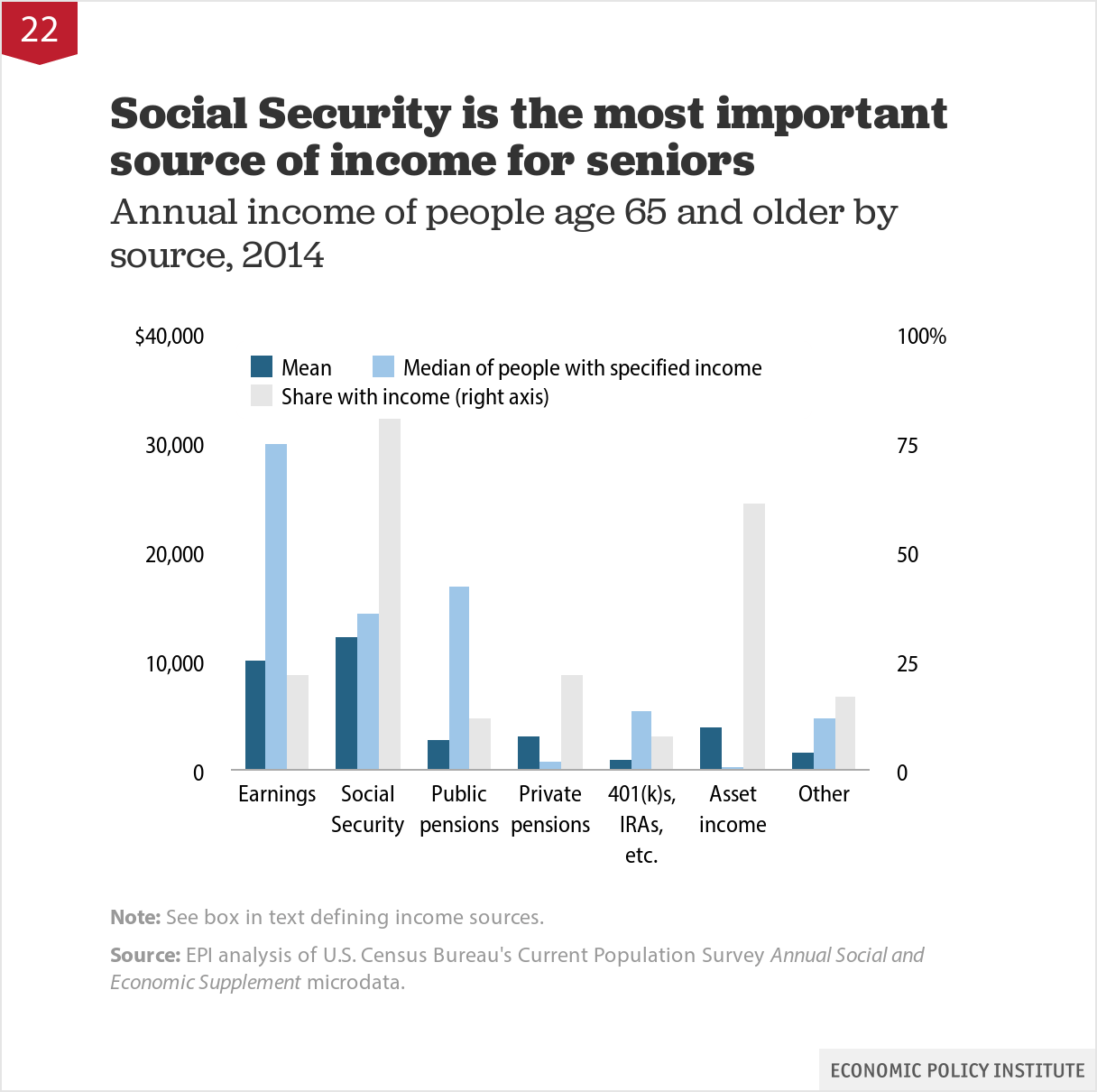

A new research study published by the Economic Policy Institute shows that Social Security is the most important source of income for seniors when compared with all other sources of income. From the report:

Click to enlarge

Social Security is the most evenly distributed source of retirement income, with 82 percent of people age 65 and older receiving benefits. Among senior beneficiaries, the median benefit is $14,400. Though 61 percent of seniors receive interest or other asset income—the next most common source of income—amounts are too small to matter much for most seniors. Earned income is a major source of income, but only for the 22 percent of seniors with earnings. Public and private pensions are a much more important source of income than distributions from retirement accounts.

Source: The State of American Retirement – How 401(k)s have failed most American workers by Monique Morrissey, EPI

So anyone that bashes the Social Security system needs their heads examined……