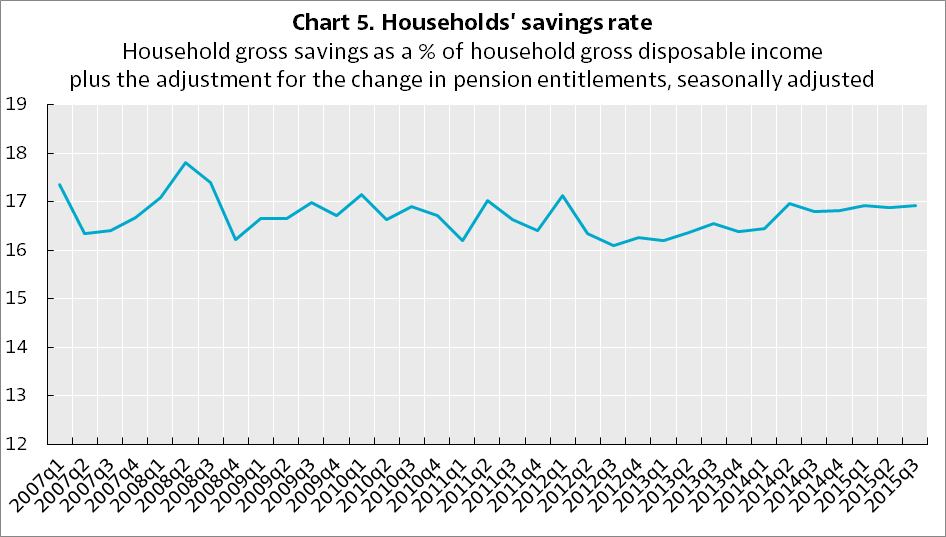

The household savings rate in Germany is much higher than in the US. In fact, the German rate is one of the highest among the OECD countries, according to a report by the OECD. The average household savings rate in Germany is 16.7%. In the third quarter of 2015, the savings rate was 16.9%. The German rate is also relatively stable and varies the least when compared with other OECD countries.

The Household Savings Rate in Germany:

Click to enlarge

Source: A dash of data: Spotlight on German households, OECD

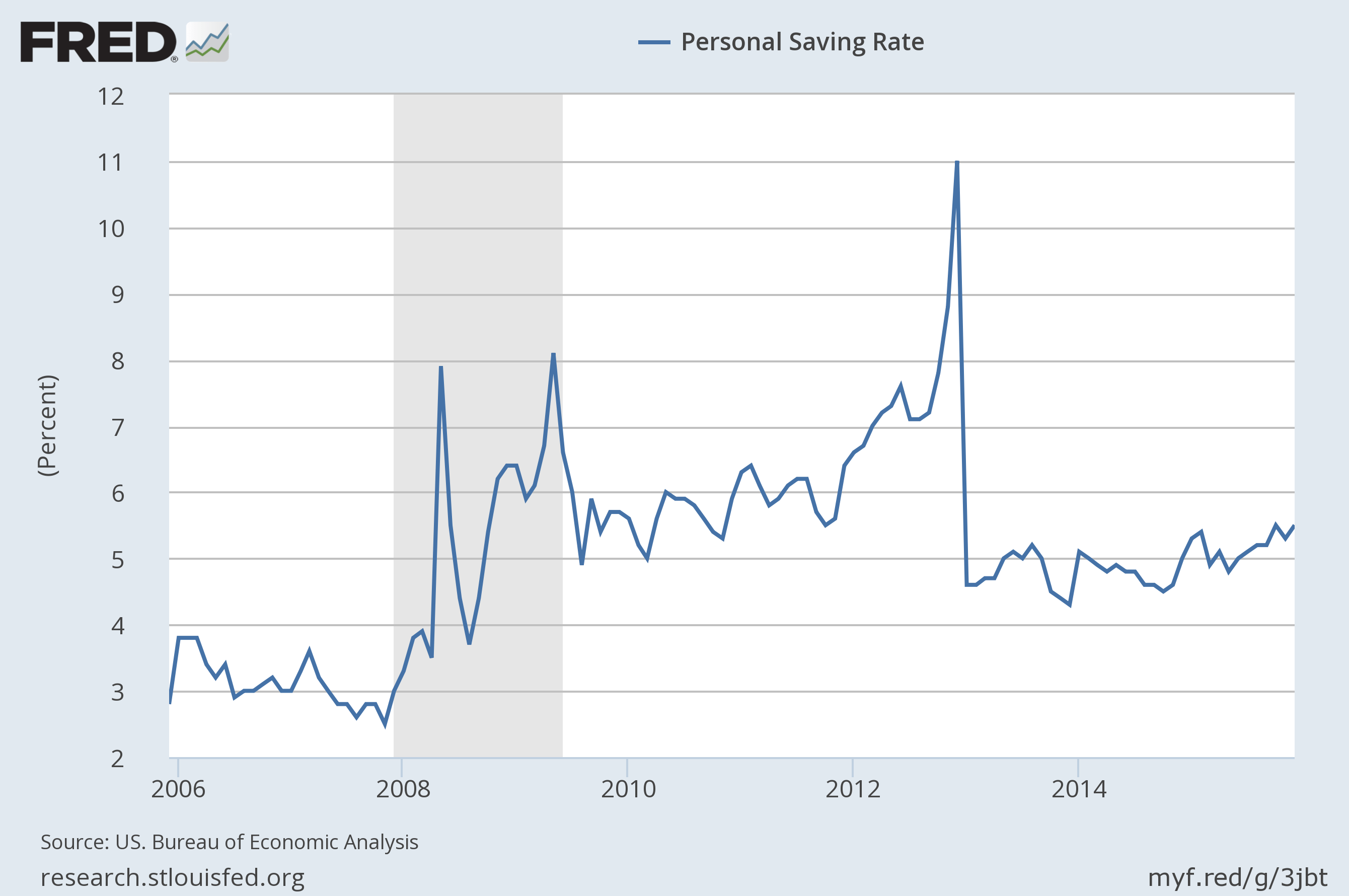

Compared to Germans, Americans save very little. In fact, the personal savings rate in the US is in the single digits.

The Personal Savings Rate in the US:

Source: FRED, Federal Reserve of St.Louis

At the end of last year, the rate stood at just 5.5% according to Federal Reserve data, Americans save about 1/3rd of the savings than Germans. In the US, the savings rate was nearly half the current rate before the global financial crisis of 2008-09.

As a socialist country Germany offers many benefits such as free healthcare for all, free college, pension, etc. to its citizens, So Germans could spend more and save less. But due to cultural reasons, Germans are traditionally risk-averse and debt is considered as a negative or a bad thing to have. Hence Germans tend to save more and pay with cash for purchases as opposed to using credit cards or take on home loans.

Americans on the other hand get limited benefits from the state and fund themselves for much of the needs such as education, healthcare, retirement, etc. So it may seem prudent for Americans to save more for the future. But due to cultural and other factors, Americans save less as evidenced by the very low savings rate and consume more goods and services, Much of the economy in the US is driven by credit and taking on debt is almost considered as a right rather than a bad thing or a privilege Other factors such as heavy marketing at all levels by companies encourages people to spend than save.