India has been a low-yielding country in terms of dividends historically. So global investors looking for income are better avoiding Indian equities. As an emerging market, India is well-suited for finding growth-oriented stocks as opposed to dividend stocks.

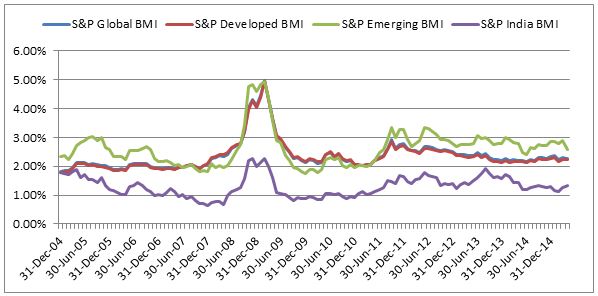

The chart below shows the historical yield comparison of India and other indices:

Click to enlarge

Source: The Tale of Dividend in India, Utkarsh Agrawal, S&P Indexology

The difference between S&P India BMI Index and S&P Developed BMI Index was almost 88bps (basis point) as on April 30 2015 according to S&P. In addition to lagging the yield of developed markets, India also lags the yield rates of other emerging markets as shown in the green line above. As a result investors hunting for dividend stocks can focus on other emerging markets.

Four reasons for the low dividend yield rates of Indian stocks are:

- Historically many Indian firms were not shareholder friendly.

- Many of the family-owned firms do not like to share the company’s profits with shareholders.

- The corporate debt market is immature and tiny compared to developed countries. Hence most Indian firms cannot depend on the debt market to raise capital. This drawback forces them to withhold profits as retained earnings to plow back into future capital investments.

- The dividend culture is still in development phase as most investors tend to invest in equities for price appreciation as opposed to steady income quarter after quarter.

Among the Indian ADRs trading in the US markets, ICICI Bank Ltd(IBN) and HDFC Bank Ltd (HDB) have dividend yields of 2.17% and 0.64% respectively.These two large private sector banks paying such low yields is one example of low dividends. In the IT services sectors, Wipro Ltd(WIT) and Infosys Ltd (INFY) have yields of 1.58% and 2.29% respectively.

Relative to the low yields offered by Indian companies, other merging companies have better yields. For instance, at the end of September the dividend yields(based on MSCI Indices) of select countries are noted below:

- Brazil: 5.10%,

- Taiwan: 4.33%

- South Africa: 3.77%

- China: 3.72%

Source; Thornburg

In summary, it is wise to invest in Indian equities for growth and not for yield.

Disclosure: No Positions