Emerging market equities should be part of a well diversified portfolio. As an asset class, emerging stocks generally tend to more volatile than developed equities. Despite the volatility investors should allocate some portion of their portfolio’s assets to emerging markets.

One of the reasons for holding stocks from the developing world is that economic growth in these markets is stronger during periods of expansions relative to the developed world. As a result, investors can earn a higher return by investing emerging equities. Another reason to invest in emerging markets is that they usually trade at a discount to developed markets. This is because investors are willing to pay a premium for developed equities for many reasons such as transparency, governance, political stability, etc. that are not widely prevalent in most emerging markets.

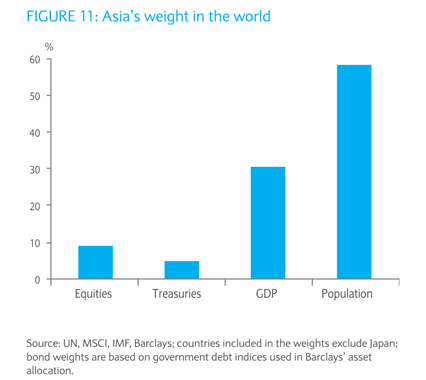

Let us discuss this concept using Asian as an example. The chart below shows Asia’s weight in the world:

Click to enlarge

Source: The butterfly effect, Barclays

From a global perspective, Asian countries account for about 60% of the world population. Two of the world’s most populous countries with populations exceeding more than a billion – China and India – are in Asia. More importantly, in terms of global GDP, Asia’s contribution is about 30% which is substantial. However when we compare Asia equities to global equities, Asia accounts for less than 10%.

So though Asian economies contribute 30% of the global GDP, Asian equities amount to under 10% of global equities. As mentioned earlier, this is because emerging Asian equities trade a discount to developed equities. However as Asian economies grow, over time this gap should decline. Hence investors looking to diversify can consider adding Asian emerging stocks in a phased manner.

Some emerging Asian stocks to consider include:

China – PetroChina Co Ltd (PTR) and Sinopec Corp (SNP)

India – ICICI Bank Ltd(IBN), HDFC Bank Ltd (HDB), Dr. Reddy’s Laboratories Ltd. (RDY) and Infosys (INFY)

Taiwan – Taiwan Semiconductor Manufacturing Co Ltd (TSM)

Philippines – Philippine Long Distance Telephone Co (PHI)

Disclosure: No Positions