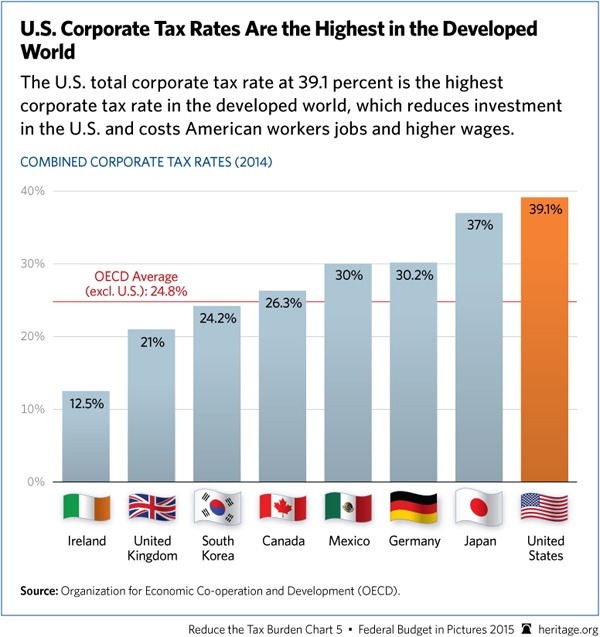

The U.S. Corporate Tax Rate is one of the highest in the world especially among the developed world peers. The total corporate tax rate at 39.1% is the highest in the developed world as shown in the chart below. This rate is higher than the OECD Average at 24.8%.

Click to enlarge

Source: The Heritage Foundation

This high tax rate is one reason why U.S. firms have stashed billions of dollars overseas and are unwilling to repatriate them home. As long as the funds stay abroad they are able to escape the high taxes. High tax rates not only prevent the repatriation of cash from overseas, but also the productive use of all that cash. For example, funds could be invested here creating jobs and potentially higher wages offered to workers.