The S&P 500 is up by 2.11% year-to-date. Compared to this low return, many European indices have double digit returns so far this year.For example, the STOXX 600 is up by 11% and the CAC 40 has increased by nearly 16%.

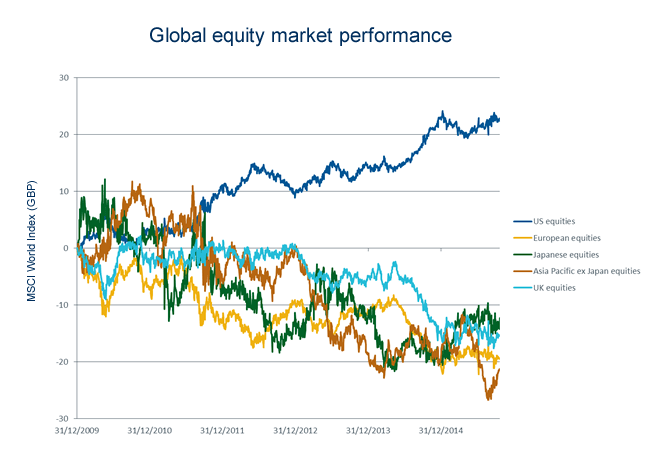

However over the past few years US equities have greatly outperformed European and other global equities as shown in the chart below:

Click to enlarge

Note: The chart is based on MSCI Index returns in British Pound terms

Source: US equities: the best house on a bad street, Money Observer

The US equity market has performed extremely well due to many reasons including: the strength of the dollar, strong earnings, economics stability at home, stock buybacks, etc.

The rally in US stocks may not continue in the future. Even if US stocks do not outperform, European stocks especially have plenty of favorable factors to beat US equities. Some of the reasons to consider adding foreign developed equities to a diversified portfolio are:

- Since European and other developed stocks have lagged US stocks they are more likely to play catch up and hence have room to grow. Moreover the best time to buy stocks is when they are cheap and valuations are low.

- Dividend yields are generally higher overseas relative to the low 2% yield for the S&P 500.

- Certain sectors of the US market such as utilities and transportation are lagging this year.This does not bode well.

- Ultra-low interest rates have helped US firms engage in buyback binges of their own stocks and take on huge debt loads as well. When interest rates rise this party may not continue.