Halloween for 2015 is over. Investors may have been scared by the ghouls, spooky goblins, ghosts and haunted houses. However the real scary part for investors may come sometime in the future. One of the causes of the Global Financial Crisis(GFC) of 2008-09 was derivatives. These scary financial instruments are like hand-held grenades. Careless handling will lead to catastrophic results.

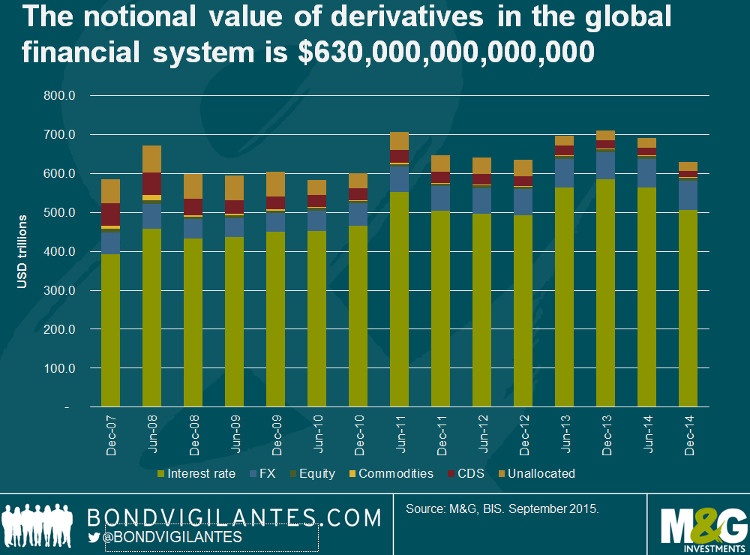

According to one estimate, the notional value of derivative exposure in the global financial system is a mind-boggling $630.0 Trillion.

Click to enlarge

From an article in Money Observer:

The notional value of derivatives in the global financial system is around $630 trillion (£410.9 trillion). To put this in comparison, the value of global GDP is $77.3 trillion.

Whilst $630 trillion is a huge number, it does overstate the dangers lurking in the global derivatives market. The notional amount does not reflect the assets at risk in a derivatives contract trade.

According to the BIS, the gross market value of the global OTC derivatives market is $20.9 trillion (close to a third of global GDP).

Source: Five scary charts Freddy Krueger would be proud of, Money Observer