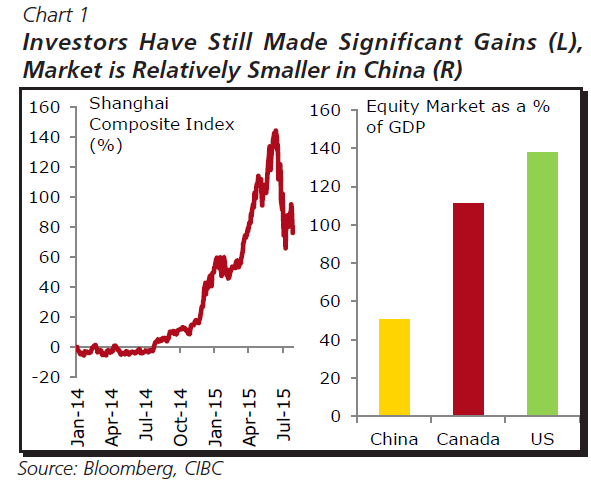

The Shanghai Composite Index is basically flat year-to-date.After a strong run up Chinese equities plunged heavily a few weeks ago. Now they appear to have stabilized due to meddling in the market by the state.

Though much of the media has focused on the Chinese equity market and the economy, the reality is that the stock market in China is small when compared to other countries. For example, the stock market capitalization of all the listed firms as a percentage of the GDP in China is smaller than in the US and Canada. Hence the spillover effect due to the fall in equity prices on China’s real economy will be small. In addition, Chinese households hold only a small portion of their financial assets in stocks compared to Americans.

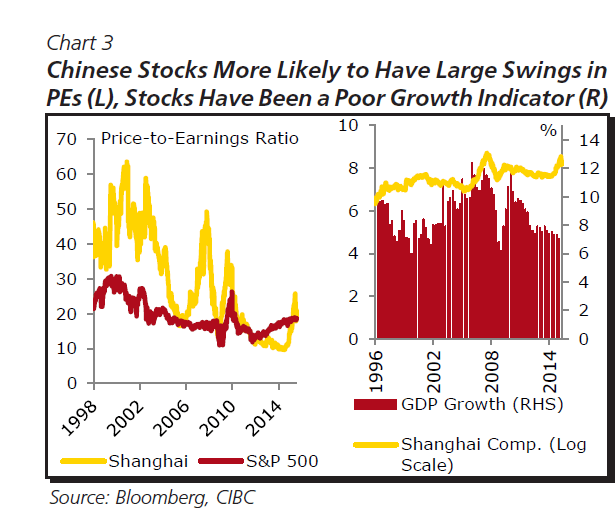

In general, there is very low relationship between a country’s economic growth and equity market growth. In China also the stock market is not a leading indicator of economic growth and vice versa.From last year thru the peak this year Chinese equities soared while the underlying economy barely experienced growth.

Click to enlarge

From a CIBC research report:

During the late 1990’s and early 2000’s the market’s performance seemed almost inversely correlated with the economy’s growth. Around the time of the financial crisis, the relationship between these two variables seemed to grow stronger. However, the recent run-up and crash appears to prove that that correlation was tenuous at best and points to the weak predictive power of Chinese equities.

Source: China’s Irrational Exuberance by Royce Mendes, CIBC World Markets, Aug 11, 2015