In recent weeks, emerging markets such as the BRICs have become more like submerging markets. One way investors can diversify their portfolios is to consider including equities from frontier markets. However frontier stocks are not for the faint of heart. These markets tend to highly volatile and can decline sharply for a variety of reasons including liquidity and political upheavals. For example, during the Egypt political crisis a few years ago, the market was shutdown for many months and stocks plunged by over 75%. As mentioned earlier such huge losses cannot be borne for most retail investors. However for those willing to take the risk, frontier markets such as Egypt, Pakistan, Nigeria, etc. offer some potential advantages such as the low correlation to emerging and developed markets.

From an article by Franklin Adatsi in Money Observer:

In an era of rising systemic risks, the attractions of an emerging markets portfolio can be enhanced by diversifying the potential sources of alpha, and adding frontier exposure can be one way to go about this.

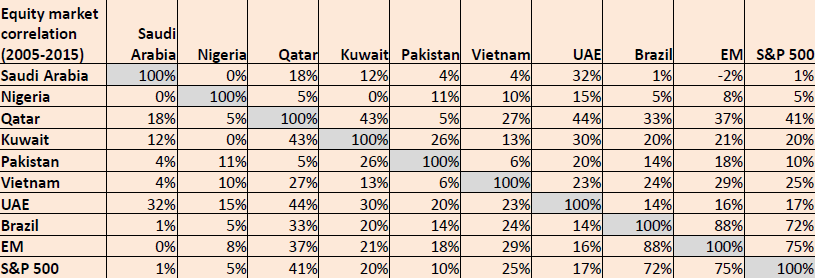

With low correlation to each other and to emerging markets (as shown by the table below, click to enlarge), frontier markets can help diversify country risk, a major risk factor for emerging market portfolios.

China, South Korea and Taiwan make up 50 per cent of the MSCI Emerging Markets Index and key non-Asian markets such as Brazil, Russia and Indonesia tend to be highly correlated with China and the emerging markets index.

Click to enlarge

With the concentration of country risk and the high correlation between major emerging market country stock indices, seemingly isolated economic events in one country can create knock-on effects that can be felt more widely. Frontier markets, do of course, carry considerable risk, but crucially these tend to be more country specific.

Source: Frontier markets: what’s in a name?, Money Observer, Sept 7, 2015

For example, Saudi Arabia has just 1% correlation with the S&P 500 and a negative correlation with emerging markets.

Investors that have the risk tolerance to invest in frontier markets should consider ETFs rather individual stocks.The iShares MSCI Frontier 100 (FM) ETF contains the top 100 companies from these markets and provides a simple way to access them.

Disclosure: No Positions