The energy sector comprising mostly the oil industry is a major sector of the economy in certain markets than others. For example, in many emerging markets the oil companies dominate the economy. Firms such as Petronas of Malaysia, Statoil of Norway, Lukoil and others of Russia, etc. dominate the respective local economies in terms of revenue and earnings.

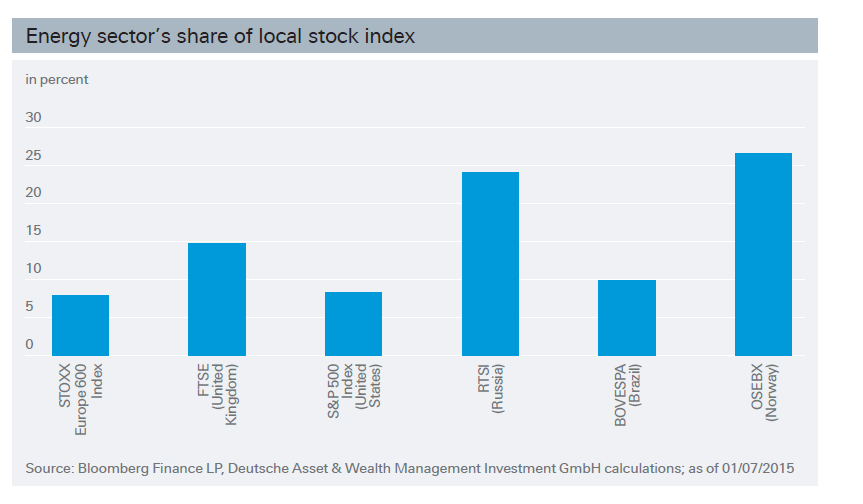

According to a report by Deutsche Bank, investors in 2015 have to consider the importance of energy sector to a market index when making their decisions. The following chart the share of the energy sector in the local stock market’s benchmark index:

Click to enlarge

Source: CIO View Special, Feb 2015, Deutsche Asset & Wealth Management

From the report:

Since the major stock indices overweigh the energy sector compared to its economic significance, a lower oil price can result in lower aggregate index gains, even in an environment of GDP growth. Every oil-price decline by $10/b is likely to lower S&P 500 Index and STOXX Europe 600 Index gains by 1%.

The benchmark indices of Russia and Norway have very high concentration of the energy sector. Some of the large Russian oil firms include LUKOIL (LUKOY), Gazprom (OGZPY) and Rosneft Oil Company (OJSCY). Norway’s Statoil (STO) is the largest oil firm in the country and is also a major global player in the industry. Though the price of Statoil ADR has fallen to about $19 now due to collapse of oil prices, still the firm has a respectable market cap of about $60.0 billion. Brazil’s Petrobras (PBR) has become a fallen angel due to the corruption scandal but seems to be on the mend this year.The ADR has nicely jumped from under $5 a share recently to close at $7.75 yesterday.

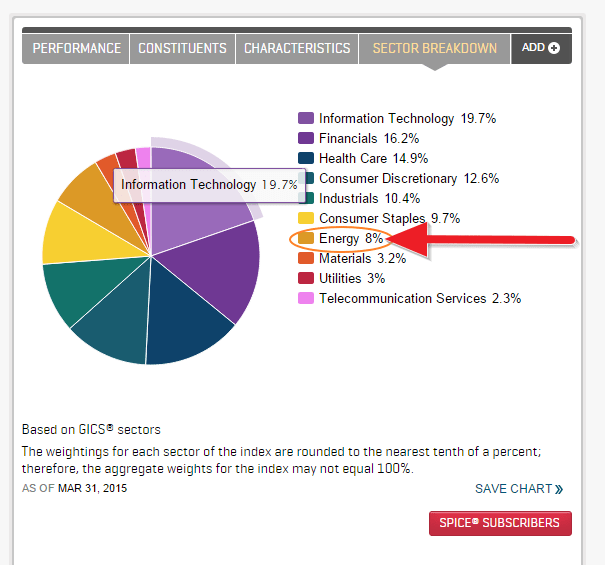

The U.S. economy is highly diversified and the S&P 500 reflects that. The energy industry accounts for just 8% of the index as the graph shows below:

Click to enlarge

Source: S&P

Since the S&P 500 highly diversified the index has not tanked heavily despite the dramatic plunge in oil prices in the past few months.

The key takeaway for investors from this post is that the equity markets of countries with high oil industry concentration will be affected by the movement of oil prices. For instance, the Russian economy and the RTS index will bounce sharply should oil prices recover strongly this year.

Disclosure: Long PBR