Inflation is an economic concept that drives prices of goods and services up. The increase occurs over time. Even in capitalist economies such as the U.S. prices of goods and services increase year after year contrary to economic principles like supply and demand. Prices are pushed ever higher by companies for a multitude of reasons the most important of which is to make higher profits. Another reason prices rise is because of the existence of cartel-like systems in most industries in the country which allows companies to legally take price increases as high the market can bear. Despite the presence of ant-trust laws on the books, the state allows oligopoly, duopoly and even monopoly to thrive in many industries. As a result while certain things like a burger may be available at a fast-food joint for dirt-cheap price of $0.99 other products such as prescription drugs, automobiles or services like top quality cell phone plans, cable tv, health insurance, etc. cost an arm and a leg.

Since inflation erodes the purchasing power of money it is important to invest in assets that produce returns that beats inflation. For example, if the inflation rate is 10% in a country and bank deposits earn 5% and equities return 20% it does not make sense to save in bank deposits since one would actually lose money in terms of purchasing power.

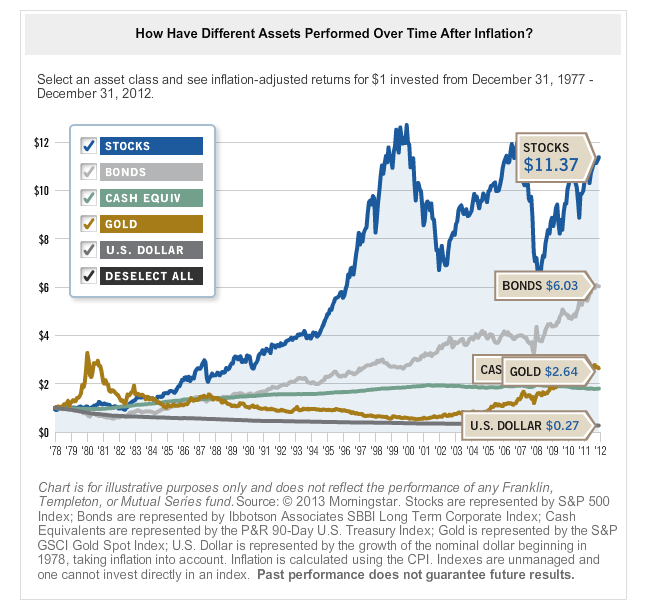

The chart below shows performance of various asset types over the long-term after inflation:

Click to enlarge

Note: Cash Equivalents grew to $1.80 during the period shown.

Source: Equities Help Protect Purchasing Power, Franklin Templeton Investments

Stocks beat all other asset types over the long-term by a wide margin including gold. The U.S. dollar is one of the hard currencies in the world. But it has lost an astonishing 73% of its value from 1978 thru 2012.

The key takeaway from this post is that since investors cannot control inflation, prices of goods and services, money supply, etc. they can focus on things that are under their control like deciding which asset type to invest in for the long-term.