One of the questions facing investors in emerging market equities is whether they should buy stocks and hold for the long-term or even very long-term. Generally long-term can be defined as investment periods of 5-10 years while longer periods can be considered as the very long-term.

In this article let us analyze this issue and try to come up with possible conclusions.I will use India as an example since has become the hot destination for foreign investors recently.Other emerging markets such as Indonesia, Turkey, Mexico, Brazil, China, etc.also share similar characteristics as the Indian market and hence the conclusions drawn from the Indian context can be extrapolated to other markets.

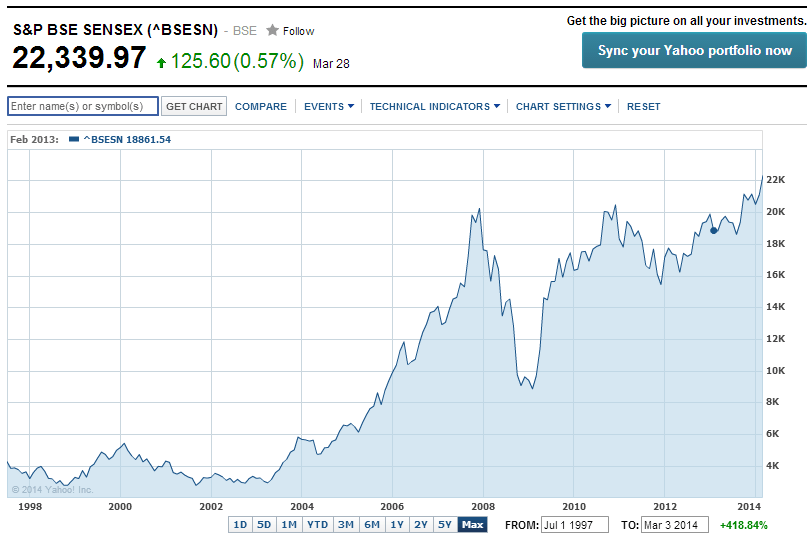

India’s benchmark stock market index Sensex closed at a record 22,339 yesterday. Indian stocks have been soaring many months now based on the expecation that the opposition candidate Narendra Modi will win in the upcoming election and

become the leader of the world’s second most populous country. He is considered to be highly business-friendly.Foreign and domestic investors are betting that he will rekindle India’s economic growth that has stagnated in the past few years.As a result the Sensex has risen from 18,000 last August to over 22,000 now.It remains to be seen if the current rally continues after the election results are announced in early May.

The long-term performance of the Sensex is shown below:

Click to enlarge

Source: Yahoo Finance

In addition to the nice long-term performance, the index had rebounded sharply in the past five years and has more than doubled.

A recent article in The Hindu BusinessLine by Aarati Krishnan discussed some of the problems with investing in the Indian stock market over long periods. The aptly titled “Why we are short on going long” piece was based on a study of the performance of listed Indian stocks over the past two decades. The results of the study demolished some of the myths of equity investing such as the buy-and-hold strategy followed by long-term investors.

Here are some fascinating points from the study:

- The annualized return on the Sensex over the 20 year period from 1994, the annualized return was 8.50%. Though this seems decent, actually this is not good for an emerging market such as India considering inflation and other factors during the time period. The 8.50% assumes that an investor in the original Sensex adjusted the portfolio every time the index components changed.

- By now eight of the blue-chips of the index lost money, two became penny stocks and a dozen of them are now unrecognizable due to mergers and restructuring.

- An investor who invested in a company back in 1994 had a two-in-three chance of losing money had they held the original investment all through the 20 years.

- Two-thirds of the 1700 listed stocks lost money during the study period.

- 80% of the stocks generated less than 10% annual return which is low as mentioned earlier.

- The strategy of Buy-and-hold investing worked better for shorter holding periods such as five and ten years as opposed to the very long-term of 20 years.

- Though a few stocks generated enormous wealth if held during the 20 year period, an investor had a one-in-ten chance of uncovering such gems.

Source: Why we are short on going long, The Hindu BusinessLine, Mar 2, 2014

In conclusion, some of the key takeaways for investors to remember when investing in any emerging market are:

- In emerging markets, investors have to be very selective in picking stocks. Also timing is also critical since emerging markets are more volatile than developed market. For example, Brazilian miner Vale(VALE) rode the global commodities boom before falling hard in the past five years when the demand for commodities such as iron ore, copper, etc. collapsed. The stock is down about 11% in past five years. On the other hand, Mexican beverage company Fomento Económico Mexicano, S.A.B. de C.V (FMX) performed well during the same period soaring by 230% excluding dividends. Fomento is a bottler and distributor of Coca Cola products in Mexico, Central America, Colombia, Venezuela, Brazil, Argentina, Costa Rica, Guatemala, Nicaragua, Panama, and the Philippines.

- Investing for the very long-term such as twenty or more years may not work work.

- Simply buying and holding stocks over long periods is also not a good idea in emerging markets.

- Seemingly solid blue-chips can crash dramatically. For example, oil giant Petrobras(PBR) of Brazil fell from about $70 in mid-June 2008 to as low as $10 a share before recovering to about $13 now.

Related ETFs:

- WisdomTree India Earnings (EPI)

- PowerShares India (PIN)

- iShares S&P India Nifty 50 (INDY)

- iShares MSCI Mexico Investable Market Index (EWW)

- iShares MSCI Brazil Index (EWZ)

Disclosure: Long PBR