Most equity markets worldwide are down so far this year. The big sell-off in January was followed by another fall in the US markets yesterday. The S&P 500 is already off 5.76% year-to-date.Other major developed markets are also in the negative territory this year. For example, the broad market indices tracked by S&P 500 for Germany, France and Canada were off by over 4% in January alone.

Relative to developed markets, emerging markets have performed even worse. Plunging currencies in Argentina, Russia, Hungary, Turkey, Indonesia, etc. have revived fears of an emerging market meltdown. As a result, emerging stocks are having another bad year after last year’s poor performance.

Volatility is back with a vengence as triple digit losses for the Dow and S&P are occurring more frequently.In light of the high losses year-to-date in both emerging and developed markets and the tremendous volatility almost on a daily basis some investors may be thinking of dumping their equity holdings and moving to cash or other safe-haven assets now. But it is not wise to panic and liquidate stocks at current levels. While it is hard not to follow the herd and sell, panic selling has a high cost. When markets are so volatile investors should stay calm and stay disciplined and focus on their long-term goals. Emerging markets such as Turkey, Hungary, Indonesia, South Africa, etc. are not significant enough to topple the global economic recovery. Though the media may portray Turkey and Argentina as the villains for starting the current crisis, these countries are unlikely to trigger the next global financial crisis anytime soon.

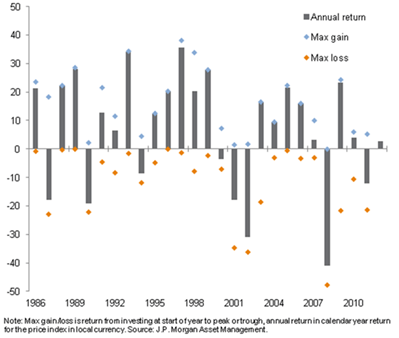

With that in mind lets discuss some of the effects of panic selling. According to an article by Tom Elliott of J.P. Morgan Asset Management, the cost of panicking can be high. The chart below shows the annual returns of the MSCI Europe Index in the grey bars and the little diamonds for each bar shows the calendar year high and low for that year as percentage returns from Jan 1st.

Click to enlarge

Source: The cost of panic, Tom Elliott, J.P. Morgan Asset Management, UK

The difference between max gain and max loss for a year is significant. Hence it is better for investors to ride out the volatility as opposed to trying to time the market.

Another important factor to note is the high risk of realizing losses at the end the year in years when the market is down. This is because the chances of the market rising sharply in the year following a down year are quite high as shown in the chart above. So an investor that sells out all his equities in a down year and shifts to cash or gold will lose out the potential big gains the following year.

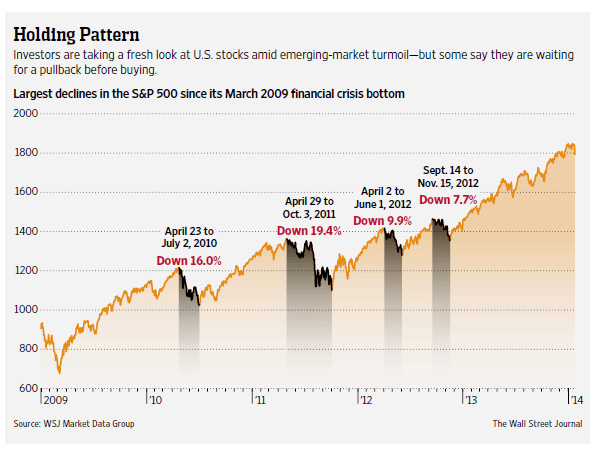

Similarly the chart below shows the largest declines in the S&P 500 since the March 2009 lows during the global financial crisis:

Source: Flight to Safety Hasn’t Left Gate, The Wall Street Journal, Jan 27, 2014

Following the same logic related to the first chart above, here too the market recovered after every decline.Investors who sold at the lows during the periods shown would have missed the run up that followed.

In summary, the main takeaway from this article is not to panic-sell during volatile market conditions. Instead one should ride out the storm and can even try to pick up high quality stocks at cheaper prices.

Related ETFs:

- iShares MSCI Emerging Markets Index Fund (EEM)

- Vanguard Emerging Markets ETF (VWO)

- SPDR S&P 500 ETF (SPY)

- SPDR STOXX Europe 50 ETF (FEU)

Disclosure: No Positions