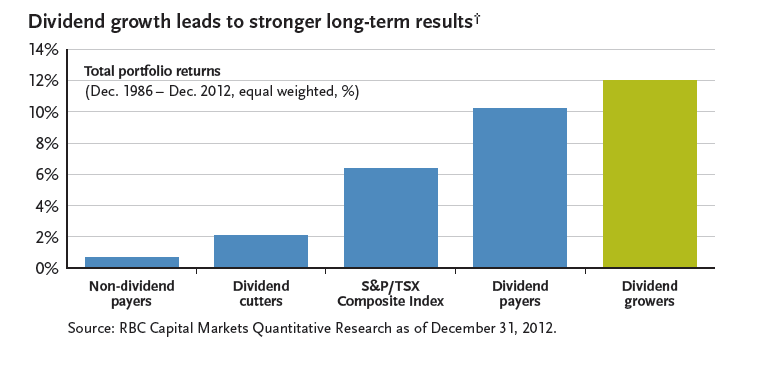

Dividend-paying stocks generally beat non-dividend paying stocks in the long run. However stocks that grow their dividends outperform dividend-payers in the long-term due to the effect of compounding and rising dividends.

The graph below shows that dividend growers outperform dividend payers in terms of total returns over the long run:

Click to enlarge

Source: Earning dividend income just makes sense, AGF Investments

The data shown above is for the S&P/TSX Composite Index, the benchmark index of the Canadian equity market from Dec 1986 to Dec 2012. It is not surprising to see that non-dividend payers are the worst performers. While dividend-payers yielded a total portfolio return of just over 10% dividend-growers earned even higher with returns of 12%. Hence from an investment standpoint, investors should select dividend-growers over dividend-payers when building a portfolio for the long-term such as for retirement.

In order to identify some dividend growing stocks I referred to the S&P/TSX Dividend Aristocrats Index. The definition of this index is as follows:

S&P/TSX Canadian Dividend Aristocrats® measures the performance of companies included in the S&P Canada BMI that have followed a policy of consistently increasing dividends every year for at least five years. Index constituents are weighted according to their indicated yield as of the last trading date in November.

Source: S&P Dow Jones Indices LLC

Ten stocks from the S&P/TSX Canadian Dividend Aristocrats index are listed below with their current dividend yield:

1.Company: Bank of Nova Scotia (BNS)

Current Dividend Yield: 3.79%

Sector: Banking

2.Company: TransCanada Corp (TRP)

Current Dividend Yield: 3.82%

Sector: Oil & Gas Transportation

3.Company: TELUS Corp (TU)

Current Dividend Yield: 4.17%

Sector: Telecom

4.Company: BCE Inc (BCE)

Current Dividend Yield: 5.11%

Sector: Telecom

5.Company: Toronto-Dominion Bank (TD)

Current Dividend Yield: 3.48%

Sector: Banking

6.Company: Suncor Energy Inc (SU)

Current Dividend Yield: 2.19%

Sector: Energy

7.Company:Rogers Communications Inc(RCI)

Current Dividend Yield: 3.68%

Sector: Wireless Telecom

8.Company:Imperial Oil Ltd (IMO)

Current Dividend Yield: 1.12%

Sector: Energy

9.Company:Canadian Pacific Railway Ltd (CP)

Current Dividend Yield: 0.88%

Sector: Railroads

10.Company: Thomson Reuters Corp(TRI)

Current Dividend Yield: 3.45%

Sector:Media

Note: Dividend yields noted above are as of Jan 6, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long BNS, TD