Utility stocks were once considered to be safe, slow and steady growers. For years they were the favorite of income investors as utilities generally had a high dividend yield relative to other sectors and for the most part they were dull and boring. With the deregulation of the industry the stability and steady growth was gone. This was true both in the U.S. and Europe. Utility stocks were no longer dependable for the steady income and growth and they started to act like stocks in other volatile sectors. A recent article in The Economist noted that the top 20 European utilities have lost about half a trillion Euros since their peak in 2008.

From the article:

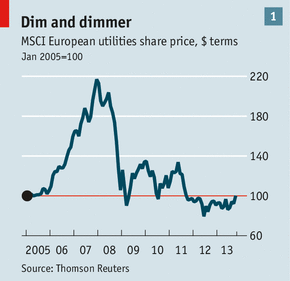

The decline of Europe’s utilities has certainly been startling. At their peak in 2008, the top 20 energy utilities were worth roughly €1 trillion ($1.3 trillion). Now they are worth less than half that (see chart 1). Since September 2008, utilities have been the worst-performing sector in the Morgan Stanley index of global share prices. In 2008 the top ten European utilities all had credit ratings of A or better. Now only five do.

Click to enlarge

As the chart shows above, European utilities are a long way from reaching the 2008 peak again. Though the overall equity markets have rebounded strongly in the five years, this sector went nowhere but down until last year. Now the sector is rebounding although at a slower pace than say the banking sector.

On the problems facing European utilities, The Economist article noted the following:

Two influences from outside Europe added to the problems. The first was the Fukushima nuclear disaster in Japan. This panicked the government of Angela Merkel into ordering the immediate closure of eight of Germany’s nuclear-power plants and a phase-out of the other nine by 2022. The abruptness of the change added to the utilities’ woes, though many of the plants were scheduled for closure anyway.

The other influence was the shale-gas bonanza in America. This displaced to Europe coal that had previously been burned in America, pushing European coal prices down relative to gas prices. At the same time, carbon prices crashed because there were too many permits to emit carbon in Europe’s emissions-trading system and the recession cut demand for them. This has reduced the penalties for burning coal, kept profit margins at coal-fired power plants healthy and slashed them for gas-fired plants. Gérard Mestrallet, chief executive of GDF Suez, the world’s largest electricity producer, says 30GW of gas-fired capacity has been mothballed in Europe since the peak, including brand-new plants. The increase in coal-burning pushed German carbon emissions up in 2012-13, the opposite of what was supposed to happen.

Source: European utilities – How to lose half a trillion euros, The Economist

The STOXX® Europe 600 Utilities Index composed of 26 of the major utilities in Europe is showing signs of recovery. In the past 5 years the index is down over 19% in Euro price terms. However the 2-year and year-to-date returns are over 2% and 7% respectively.

Investors looking to gain exposure to European utilities can consider some of them at current levels. Ten such companies are listed below with their current dividend yields:

1. Company:Electricite de France SA (ECIFY)

Current Dividend Yield: 4.64%

Country: France

2.Company:National Grid PLC (NGG)

Current Dividend Yield: 5.11%

Country: UK

3. Company:Edp Energias De Portugal SA (EDPFY)

Current Dividend Yield: 4.25%

Country: Portugal

4.Company: E.ON SE (EONGY)

Current Dividend Yield: 5.67%

Country: Germany

5. Company: RWE AG (RWEOY)

Current Dividend Yield: 7.01%

Country: Germany

6. Company: Enel SpA (ENLAY)

Current Dividend Yield: 4.45%

Country: Italy

7. Company: Fortum Oyj (FOJCY)

Current Dividend Yield: 5.69%

Country: Finland

8.Company:SSE PLC (SSEZY)

Current Dividend Yield: 5.65%

Country: UK

9. Company: Verbund AG (OEZVY)

Current Dividend Yield: 3.23%

Country: Austria

10.Company: Gas Natural SDG SA (GASNY)

Current Dividend Yield: 4.81%

Country: Spain

Note: Dividend yields noted are as of Oct 22, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long EONGY, RWEOY