Every year Credit Suisse publishes the Global Investment Yearbook which contains a wealth of data on many markets. From the 2013 edition here are two charts related to the US markets.

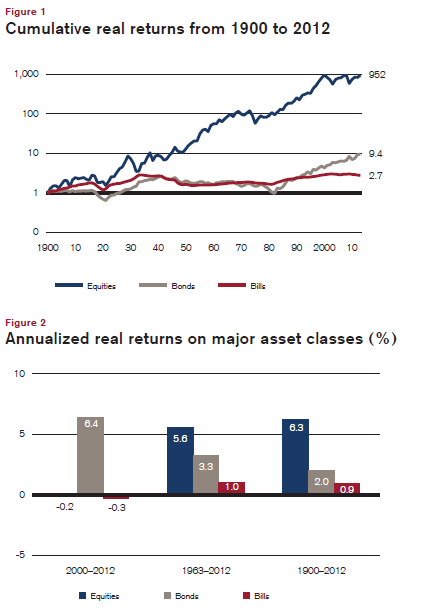

The Cumulative Real Returns from 1900 to 2012 & the Annualized Real Returns of Major Asset Classes(%):

Click to enlage

Source: Credit Suisse Global Investment Yearbook 2013, Credit Suisse

Since 1900 U.S. stocks have yielded a real return of 6.3% compared to just 2.0% for bonds. Stocks have out performed bonds strongly over very long periods.

From the report:

Figure 1 shows that, over the last 113 years, the real value of equities, with income reinvested, grew by a factor of 951.7 as compared to 9.4 for bonds and 2.7 for bills. Figure 2 displays the long-term real index levels as annualized returns, with equities giving 6.3%, bonds 2.0%, and bills 0.9% since 1900.

During the time period from 2000 to 2012 stocks had a negative return due to the global financial crisis and the dot-com implosion.