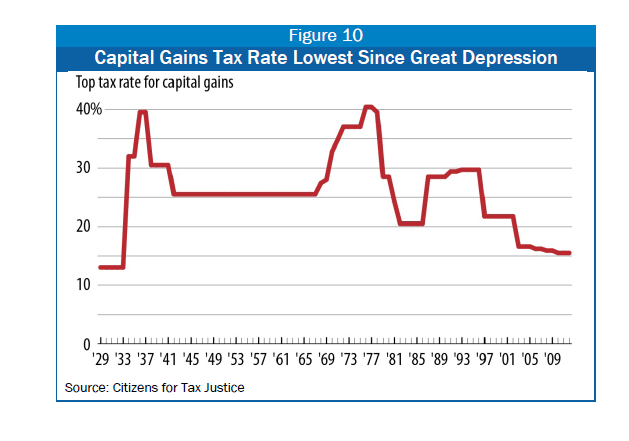

Capital gains are taxed at a lower rate than ordinary income such as salary and wages. Currently the top rate on most capital gains is 15% while the top rate on salary and wages is 35%, according to a research report by the Center on Budget and Policy Priorities. In addition taxes on capital gains are due only when the gains are realized and hence they can be postponed as long as necessary. But this is not possible with ordinary income since taxes are paid when income is earned.

Click to enlarge

From the report:

Capital gains on assets that have been held for more than one year are generally taxed at a substantially reduced rate when the gain is realized: currently a 15 percent tax rate for taxpayers in an income tax bracket above the 15 percent bracket. (People in or below the 15 percent bracket owe no capital gains tax.) This is far below the top marginal tax rate on ordinary income — currently 35 percent — and is the lowest rate on long-term capital gains since the Great Depression. (See Figure 10.)

Source: Raising Today’s Low Capital Gains Tax Rates Could Promote Economic Efficiency and Fairness, While Helping Reduce Deficits by Chye-Ching Huang and Chuck Marr, Center on Budget and Policy Priorities