The U.S. economy was mainly driven in the past few decades by the FIRE (Finance, Insurance and Real Estate) sector. Accordingly these sectors experienced explosive growth and formed a major portion of the overall economy. The banking industry especially evolved into one of the main pillars of the economic growth due to its loose lending and other activities. However after the recent financial crisis, the importance of the banking industry to the economy has diminished.

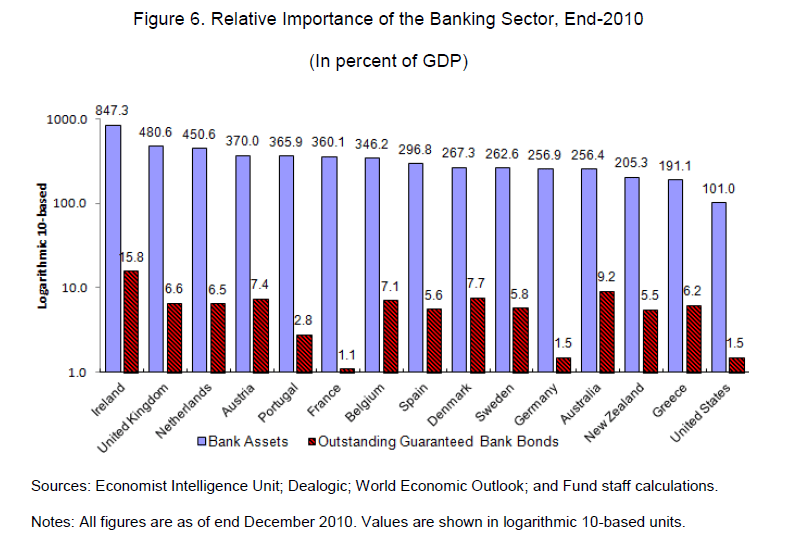

The chart below shows the relative importance of the banking sector for select developed countries at the end of 2010:

Click to enlarge

Source: Managing Sovereign Debt and Debt Markets through a Crisis – Practical Insights and

Policy Lessons, IMF

The experience of Iceland and Ireland shows the disastrous implications of the outsized growth of a country’s banking sector. In Iceland, financial sector assets expanded at an annual rate of over 100% in 2003 to over 1000% of GDP at the end of 2007. Similarly in Ireland, the assets of domestic amounted to five times that of the GDP at the height of the boom.