A recent article in the Bloomberg BusinessWeek magazine titled There’s a New Silk Road, and It Doesn’t Lead to the U.S. discussed the growing trade ties between emerging markets.

From the article:

“As the U.S. emerges from the recession, American investors often wonder where the growth is going to come from. Perhaps they should talk to Ruben Bisi, international operations director for Marcopolo, Brazil’s biggest bus maker. It’s having a banner year, with revenue up 47 percent so far. You won’t see Marcopolo buses in the U.S., though. They’re cruising the highways and city streets of Argentina, Colombia, Mexico, Egypt, India, China, and South Africa. Brazilians often have a better relationship with these customers than big multinationals do, says Bisi. “We are from an underdeveloped country as well,” he explains. Almost 40 percent of Marcopolo’s sales of $1.1 billion come from outside Brazil: It sold 460 buses to South Africa for the World Cup.

Marcopolo is a traveler on what Stephen King, chief economist of HSBC (HBC), has dubbed “the new Silk Road”—a 21st-century version of the trade routes that crisscrossed Asia almost 2,000 years ago, linking merchants in China to their counterparts in India, Arabia, and the Roman Empire. The new Silk Road spans the globe, connecting companies and consumers in Latin America, the Mideast, Asia, and Africa, and generating some $2.8 trillion in trade, according to the World Trade Organization.

King says emerging markets will grow about three times faster than rich nations this year and next. “There are now massive trade connections within the emerging markets,” he says. “It means in one sense the emerging world is protected from the worst ravages of the developed world.” The WTO estimates intra-emerging-market trade rose, on average, by 18 percent per year from 2000 to 2008, faster than commerce grew between emerging and advanced nations.”

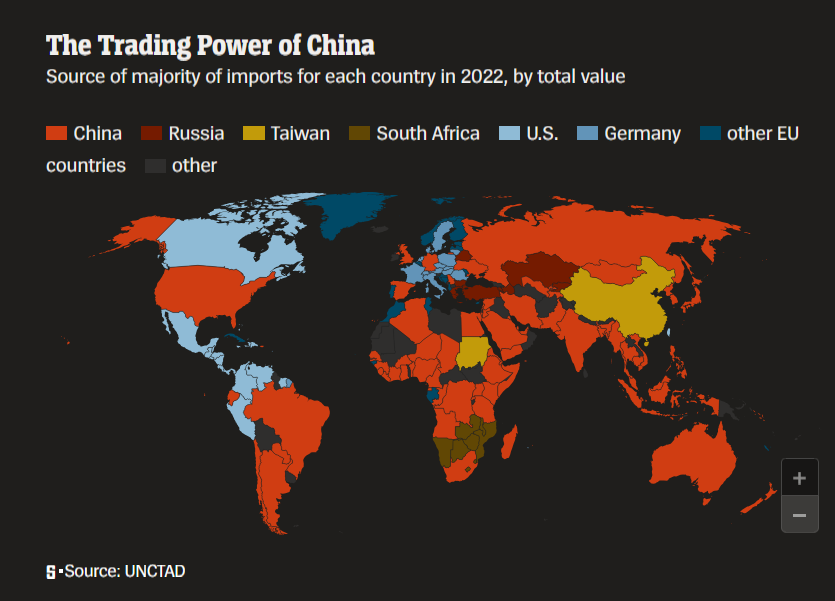

On the rising influence of Chinese firms in developing markets, the piece noted:

“While the U.S. and other developed countries hope to find their place on the Silk Road, the central player is China. Chinese exports to the emerging world accounted for about 9.5 percent of its gross domestic product in 2008, compared with 2 percent in 1985, King figures. Last month the Saudi Railways Organization awarded a contract to China South Locomotive & Rolling Stock to supply 10 locomotives. The Mecca-Medina rail contract went to Beijing-based China Railway Group (CRWOF). Shenzhen-based Huawei Technologies, China’s top maker of phone equipment, is investing $500 million in its research center in Bangalore. China Mobile, the world’s biggest phone carrier, may soon invest in Africa.”

As the U.S. and developed world economies remain sluggish, trade volume between China and emerging markets is rising at a staggering pace. In July, trade volume which includes exports and imports with foreign countries rose 40.9% compared to the same period last year. However China’s trade with emerging markets were much higher as noted in the examples below:

- Trade between China and ASEAN countries rose by 49.6%

- Trade between China and Malaysia, Indonesia increased by 60.0%

- Trade between China and Brazil, China, South Africa rose by over 50.0%

From another article related to intra-emerging markets trade :

“The Geneva-based World Trade Organisation (WTO) estimates intra-emerging market trade rose on average by 18% a year from 2000 to 2008, faster than commerce between emerging and advanced nations. It totalled $2,8-trillion in 2008, about half of emerging-market trade with all nations.

That performance is especially welcome now given the sluggish recovery in the rich economies, said HSBC’s King, author of Losing Control: The Emerging Threats to Western Prosperity and a former UK Treasury official.

Chinese exports to the emerging world accounted for about 9.5% of gross domestic product in 2008, compared with 2% in 1985, he calculated. India’s jumped to 7.3% from 1,5% and Brazil’s almost doubled to 6.3%. Emerging-market economies will grow 6.9% this year and 6.2% in 2011, King said, outpacing the 2.4% and 1.9% projected expansions of developed economies.

“There are now massive trade connections within the emerging markets and they’re becoming increasingly important,†said King in a telephone interview. “It means in one sense the emerging world is protected from the worst ravages of the developed world.—

The Chinese are making all the right moves. As China’s trade relations with the fast growing emerging markets develops further, the export-oriented economy becomes more diversified and will perform better even when the economies of the developed world struggle to gain momentum. However it must be noted that the U.S. and Western Europe will continue to remain as the largest export destinations for some time. But overtime China will become less reliant on the wealthy countries for growth as rising income levels in emerging countries coupled with demand for cheap goods make Chinese products attractive.