The Shanghai Composite index is down over 21% as of last Friday and continues to fall further. An article titled “Chinese Savers Turn to Their Stockbrokers” in the latest edition of Bloomberg BusinessWeek suggests that equities are now preferred over savings and real estate.

From the article:

“Ordinary Chinese investors are looking to stocks for a lift. If they’re not careful, they may get the opposite.

Although the Shanghai Stock Exchange Composite Index is down more than 21 percent this year, Pan Weiting sees no better place to put her money. The 27-year-old Shanghai accountant recently shelved plans to buy an apartment after real estate prices reached record highs. The 2.25 percent interest she earns on the 400,000 yuan ($59,000) she has in her bank account is being nibbled away by rising inflation, which hit 2.8 percent in April.

If Pan were an American, she might switch to international stocks, gold, or municipal bonds. China’s financial regulations, however, limit her investment choices to property or domestic equities. It’s no contest. “The stock market is the best choice for the moment,” says Pan. “Even the bank staff advised me against depositing more money.”

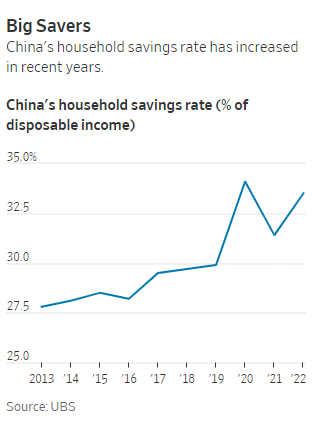

Millions of other Chinese, who on average save half their income, share Pan’s dilemma. Property prices are often out of their reach. If they do buy real estate, they risk seeing their investment wiped out should the government’s recent curbs on mortgage loans finally chill the market. Inflation is forecast to climb 3.4 percent this year, according to the median estimate of 18 economists surveyed by Bloomberg on May 11. That will put more pressure on low-yielding savings accounts. “It becomes a question of who’s the least ugly girl at the fair,” says Victoria Mio, a Hong Kong-based senior fund manager at Robeco, whose firm manages $194 billion worldwide. “There is migration [to stocks] occurring, and the shift will accelerate with a few months of negative interest rates.”” (emphasis added)

Chinese households have very low debt levels.The household debt as a percentage of GDP is about 10% .In general, Chinese households save over 25% of their disposable income.Savings by businesses and households push the gross domestic savings as a percentage of GDP to exceed 50%.The combined personal and corporate savings in China equals $7.2 Trillion.

Some of the reasons mentioned in the article for anticipated the flow of funds into equities include:

- Low to negative interest rates on bank savings accounts

- Rising inflation rate. Inflation is projected to climb 3.4% this year

- Falling real estate prices as authorities have increased bank reserve requirements to slow lending

Despite all the reasons mentioned above, I believe Chinese savers are not going to rush into equities. Many global issues such as the European debt crisis, the chances of the global economy going into a double-dip recession, the Korean issue, etc. may affect the Chinese economy leading to accelerated decline in share prices. In addition, culturally the majority of the Chinese are very conservative and prefer property investments and savings to stocks.