Australian banks have recovered strongly after the recent financial crisis and are poised to grow further with the economic rebound in Asia.The market capitalization of Australian banks increased by 64% over the past year compared to a 34% increase for the SP/ASX 200 index.

The dividend yield has been returning to normal levels in past few months as the chart shows below. In 2008, the yield rose significantly due to falling share prices and not due to increase in dividend payouts.

After a large decline in the P/E ratio in 2008, the ratio has been steadily expanding since 2009 with rising earnings as shown in the graph below.

Source: Australian Bankers Association

Source: Australian Bankers Association

In general, banks in Australia have paid out a higher proportion of their profits in dividends. Last year the total dividend payouts of all Australian banks was A$13.7 billion.

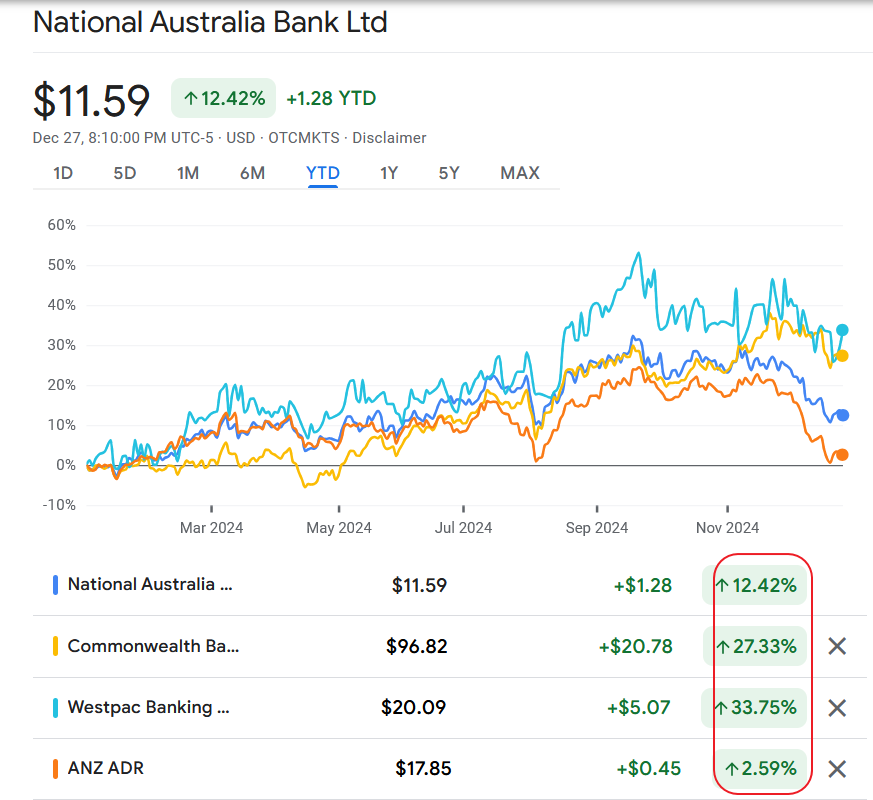

The Australian banks trading in the US as ADRs are listed below with their current yields:

1. Westpac Banking (WBK)

Current Dividend Yield: 4.19%

2. National Australia Bank (OTC: NABZY)

Current Dividend Yield: 5.17%

3. Australia and New Zealand Banking Group Ltd (OTC: ANZBY)

Current Dividend Yield: 4.28%

4.Commonwealth Bank of Australia (OTC: CMWAY)

Current Dividend Yield: No regular dividends paid