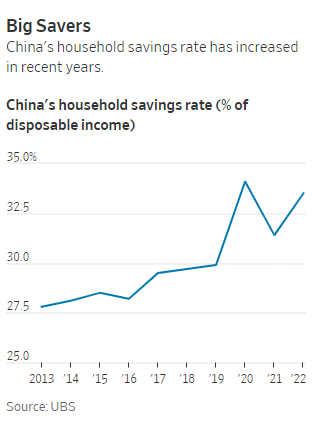

The economy of China is stable and growing due to the government stimulus program focused towards infrastructure per World Bank’s Quarterly Update. Imports of raw materials have increased though exports have not due to lack of demand from overseas. China has tremendous potential to grow the domestic market.

About 42 Chinese ADRs trade in the New York Stock Exchange(NYSE) and many more in the NASDAQ and OTC markets. In this post, lets take a look at the largest five companies by market capitalization that are traded in the NYSE.

1.PetroChina Company Ltd (PTR) is one of the largest integrated oil and natural gas producer and distributor in China. Last year the company had total revenus of $145B. The profit margin is about 11% and the average annual earnings growth is 8%. The current dividnd yield is 3.95%. As the demand for gas continued to rise in China in recent, PTR did performed well with revenues rising 28% annually.

2.China-based life insurer China Life Insurance Co Ltd (LFC) offers “a range of insurance products, including individual life insurance, group life insurance, accident insurance and health insurance products”. At the end of last year China life had “102 million individual and group life insurance policies, annuity contracts and long-term health insurance policies”. LFC pays a dividend of just 0.91%.

3.China Petroleum & Chemical Corp aka Sinopec (SNP) is another integrated oil company with operations in the Chemicals sector as well. SNP operates 16 oil and gas producing fields. Sinopec pays no regular dividends. Similar to Petro-China, SNP’s total revenues rose 26% annually over the past 5 years.

4.Telecom services provider China Telecom Corp Ltd(CHA) has a market cap of $7B. CHA’s current yield is 2.19%. Last year’s total revenue was $27B. Revenue growth was flat at 4% in recent years. Additional new services and offerings such as Blackberry and other mobile technologies should help the company achieve higher growth in future.

5.Aluminium producer Aluminum Corp of China Ltd (ACH) is “principally engaged in the extraction of aluminum oxide, electrolyzation of virgin aluminum and the processing and production of aluminum.” ACH does not pay dividends. Profit margin is a solid 20% and last year’s revenue was $9B.ACH seems inexpensive compared to its peers since the P/E is just 6.62.