The sub-prime crisis that started in the US impacted most of the world’s countries including Canada. However last year the Canadian economy stayed strong relative to other developed economies. When one looks at the macroeconomic fundamentals it does not bode well for Canada in 2009.

When researching into the reasons for the strength of the Canadian economy I came across a paper titled “The US Financial Crisis, Global Financial Turmoil, and Developing Asia: Is the Era of High Growth at an End?” published in December,2008 by the Asian Development Bank. This post summarizes some of the key points the authors note about Canada and includes some of my own observations.

Some of the reasons the economy of Canada stayed strong in 2008 are:

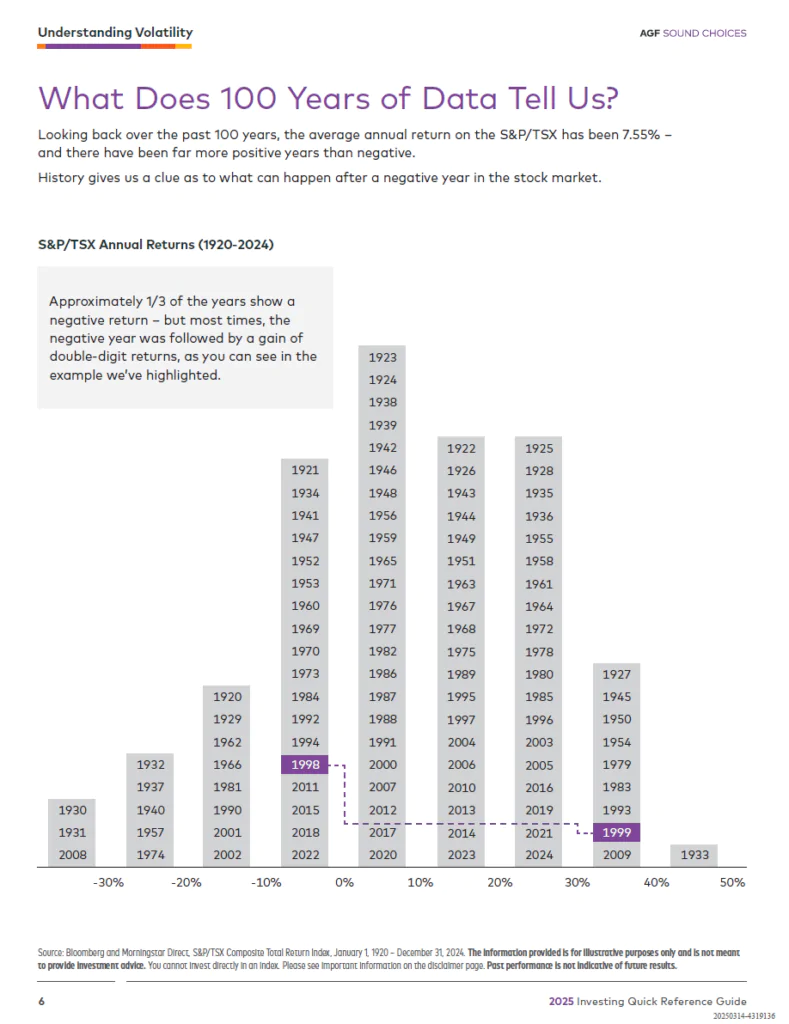

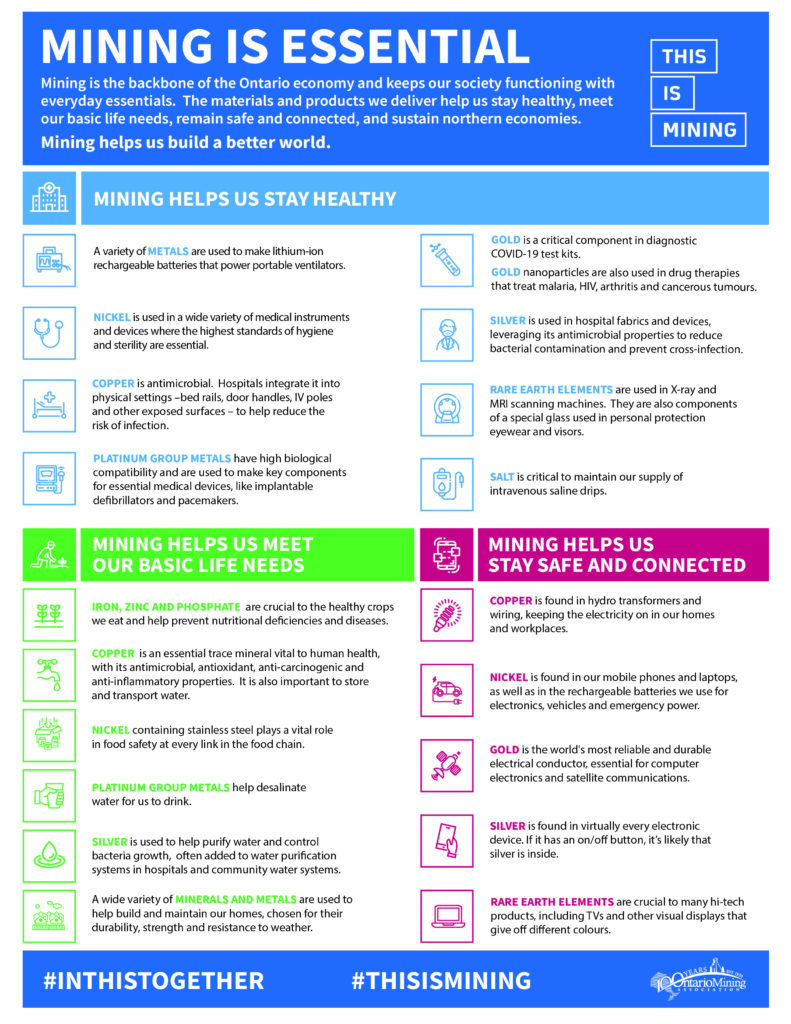

1.As a natural resources exporting nation Canada benefited well from the high commodity prices in the past few years.

2. The high commodity prices helped Canada achieve a current account and fiscal surpluses. In fact Canada is one of the one few OECD countries to have a surplus for many years now (Refer charts below).

Chart – Canada’s Current Account Balance

Chart- Canada Fiscal Balance

3. The strong fiscal and current account balance provided Canada with a “cushion” against the raging credit crisis worldwide.

4. Inflation has remained stable under 2% thru 2007 but started heading upwards since 2008 as the chart shows below

Chart- Canada CPI Inflation

5. The money supply growth has been kept under control.

6. Consumer credit growth continued to increase leading to rise in housing prices. But they have stated to cool like in other countries.

How will the economy perform in 2009?

The Canadian economy will experience slower growth in 2009 due to reduction in imports by US. This scenario is most likely to occur since USA is Canada’s largest trading partner. In 2007, 76% of all exports totaling about $440B by Canada went to the USA (Source: Wikipedia). The main exports to the US are agricultural, forestry products and energy. For the month of November,2008 alone trade between US and Canada amounted to $41.77B, the highest among all the countries the US trades with. (Source: www.Census.gov)

As the US residential and commercial real estate market continues to deteriorate the export of timber will grind to a halt.

One of the largest manufacturing sector in Canada is auto manufacturing concentrated in Ontario province. Most the cars assembled there are exported to the US. The big three US automakers and Japanese auto makers employ a large number of Canadians in the factories located in Ontario. Since the demand for new autos has fallen off the cliff in the US many of these factories will be affected. In addition to the automakers, many auto parts manufacturers have plants as well in Ontario. Already there have been news reports of layoffs in some of these companies.

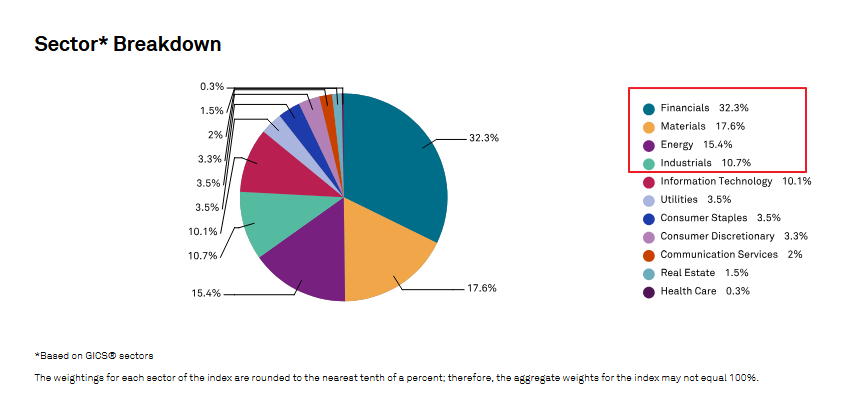

Another sector that will face the effects of slowdown more quickly is the oil and natural sector. The Toronto Stock Exchange (TSX) site states “More oil & gas companies are listed on Toronto Stock Exchange (TSX) and TSX Venture Exchange than any other exchange in the world. At the end of November 2008, there were 404 oil & gas companies with a total market capitalization of $295.2 billion listed on Toronto Stock Exchange and TSX Venture Exchange”. Since the consumption of gas has decreased dramatically in the US last year the demand for Canadian crude has decreased as well.

Overall though Canada will not be affected heavily due to the financial issues related to credit crisis, the economy will experience slower growth due to the lower imports by US. It is highly unlikely that Canada’s second largest trade partner China and other countries will be able to substitute for the loss of US demand for Canadian resources.