For other Australian Bank ADR stocks click here:

Stock Split:

NABZY used to trade at around $140 back in March. But now it goes for $29.00.How is this possible?

This is because before the ADR stock used to represent 5 NAB share in Australia. But effective March 26, 2008 they changed the ratio to 1:1. This means now 1 ADR stock represents 1 local NAB share. Due to this change, the $140 stock before now got cheaper and sells at a much lower price. This is like giving a 5 for 1 split to ADR shareholders and hence shareholders who held the ADR before the effective date would now have 5 times the number of shares.

Intro:

National Australia Bank is one of the largest banks in Australia. The ADR stock used to be listed in the NYSE as NAB. But last year in June, it moved to the OTC market and now trades as NABZY.

A brief overview from NAB’s corporate site:

“The National Australia Bank Limited is an international financial services organisation that provides a comprehensive and integrated range of financial products and services. Our history traces back to the establishment of The National Bank of Australasia in 1858.

The Group is organised around three regional businesses: Australia, UK and New Zealand. These regions include the retail and business banks, wealth management services and the transactional and custodial operations of the former Institutional Markets & Services division. In addition, we have a global business in NABCapital, which focuses on debt, risk management and investment products for corporate and institutional customers.

Our retail bank brands are NAB and MLC, Bank of New Zealand (New Zealand), Yorkshire Bank and Clydesdale Bank (United Kingdom).”

In Australia the bank has more than 24,500 employees who serve customers through more than 790 branches, 150 business banking centres, 110 regional agribusiness locations and three major contact centres. The region also administers NAB’s presence in parts of Asia – which has a lot of growth potential.

NAB’s Financial Stats:

Stock Ticker – NABZY.pk

Market Cap. – $44.5B (As of April 3rd, 2008)

Shares Out – $1.6B

Dividend Yield – 5.87% (As of April 3rd, 2008)

52 Week Change – Down about 16%

5 Year Earnings growth – 18.95%

Profit Margin – 27.38%

PE – About 11.47

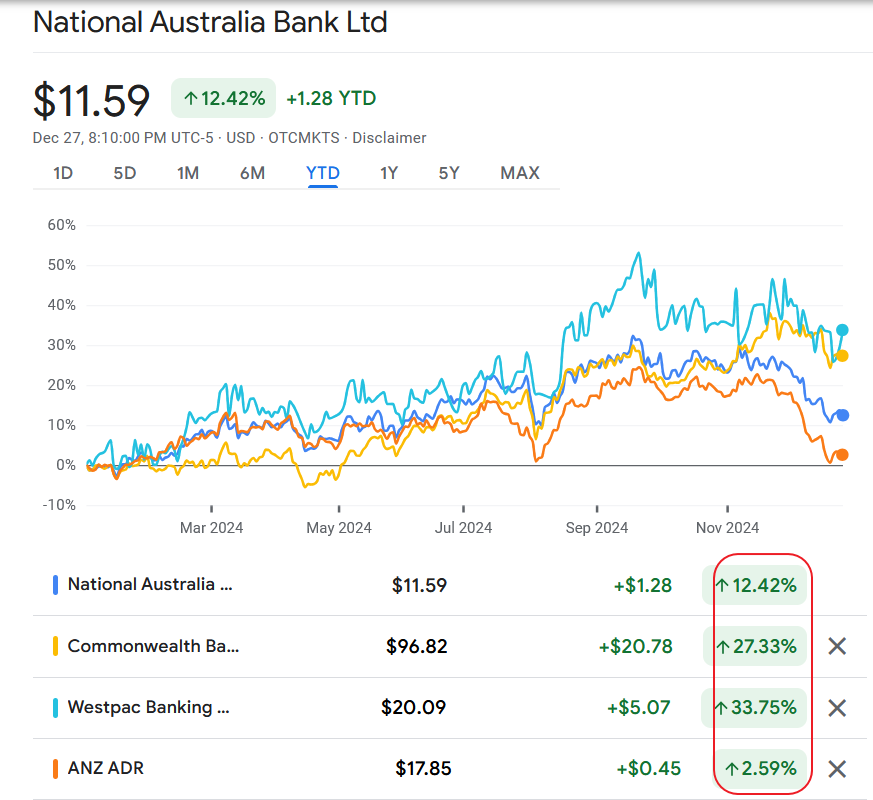

Some of the competitors of NAB are Westpac Banking which trades as WBK and Australia and New Zealand Bank – ANZBY.

Stock Performance:

The stock has had a great run for the past 5 years and the dividend yield is a big kicker too.

An investment of $10K 5 years ago would now have more than doubled. NAB has increased dividend each year in the past 5 of 6 years.

For many years the dividend has been paid consistently and the payout ratio is well over 50%. All these positive factors make NABZY a solid performer !!!

Sources:

www.nabgroup.com