Part II:

There are many ways to invest in Canada. Some of them are discussed below:

1. ETFs

2. Income Trusts

3. Stocks

1. ETFs:

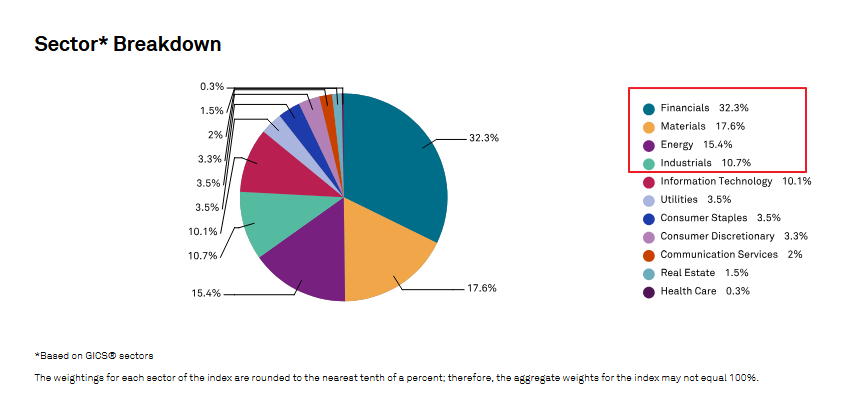

This is the easiest and quickest way to get some exposure to Canadian equities. iShares’ Canada ETF – EWC is the best one in the market. It has assets of over $2.0B and has performed consistently over the years.Last year, it returned over 25% due to the bull run in the energy and commodity sectors. With this ETF you get diversification of Canadian stocks easily. To build a portfolio of stocks will take time and lots of $.The fund has is heavy in commodities (energy,materials) & financials. this makes sense since Canada is commodity based country.

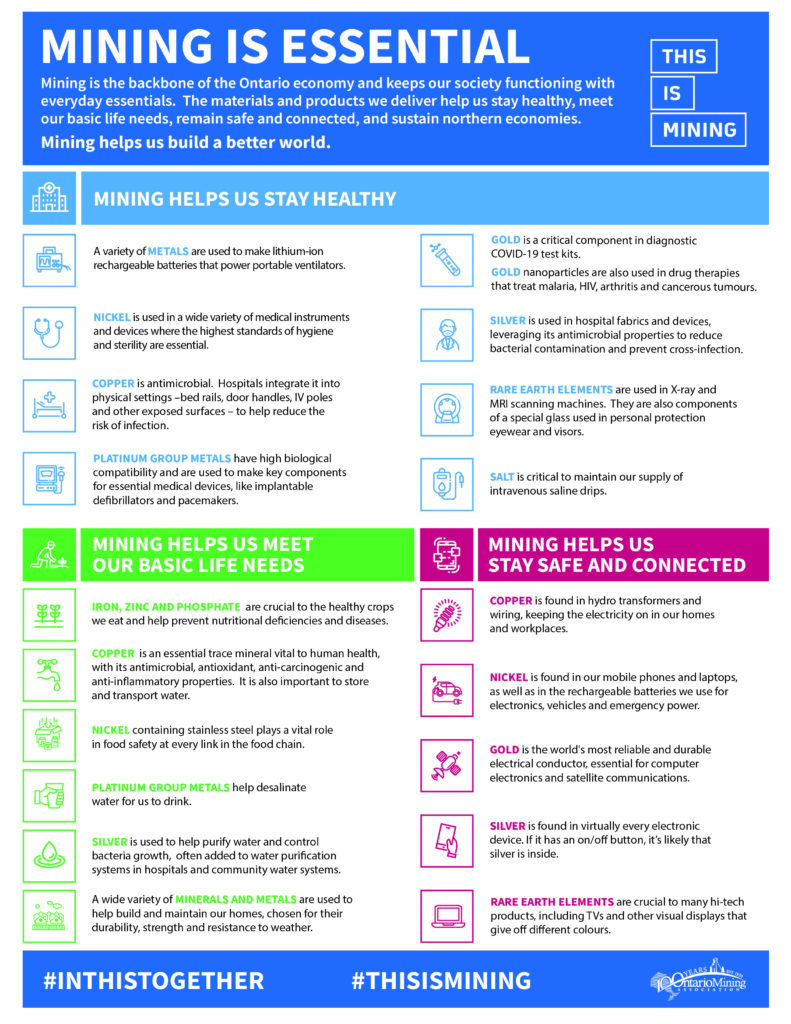

Some of the commodities that are abundant in Canada are uranium, Potash (used in fertilizer), diamond deposits, oil (in the form of tar sands) etc.

Note:The tar sands of Alberta province release oil when pressed under heavy pressure. After a Canadian scientist invented this process, all of a sudden Canada turned into a big oil producer.

In fact the government of Alberta swims in oil money so much that even sends out checks to folks in the province once in a while.

The best part about this ETF is that it has the highest allocation (6.05%) for Royal Bank of Canada – RY. This is one of the best performing bank stock with great dividends too. RY is the largest and the most profitable all the banks in Canada.

2. Energy Trusts:

If you are looking for a higher than average income, then Canadian Royalty income trusts maybe the answer. These trusts are very popular among investors. They are able pay dividends of 10% and up because of favorable tax treatments from the government. These trusts basically own a piece of land and all the revenue coming from oil pumped from that land gets distributed to shareholders. When they run out of oil or land or both, trust usually try to acquire new land for growth.

A few of these trusts are listed below:

1. HARVEST ENERGY TRUST – HTE with 17% Yield

2. ADVANTAGE ENERGY FD – AAB with 15.8% yield

3. FORDING CDN COAL – FDG with 5.7%

4. PENGROWTH EGY UTS – PGH with 15.4%

Caution: Though they pay high dividends and some capital appreciation, there are many risks involved with investing in these trusts. Firstly a small fall in share price of a few $s can easily wipe out a years worth of dividends received. Also sometimes trusts may not be able to find land. Sometimes trusts may not have enough profit to distribute to shareholders.

3.Stocks:

There are many high quality Canadian stocks available in the US.The best ones are the producers of Potash, energy related companies, rail transportation and banks.

Importance of Rail Transportation: All the commodities such as lumber,wheat,crude oil etc. have to shipped to different parts of Canada and down south to US and beyond.Most of this freight is transported by two rail companies. They are the Canadian Pacific – CP and

Canadian National – CNI. These two are strong performers although in the past year or so CP has done a lot better than CNI.

For more Canadian Stock listings visit:

https://www.topforeignstocks.com/5.htm

For Canadian Stocks that have grown over 200%,300%, even 490% in the past 5 years

please visit:

https://www.topforeignstocks.com/18.htm

Happy hunting of Canadian Stocks !!!! And don’t forget to write a comment in my blog if you find this information useful.:-)