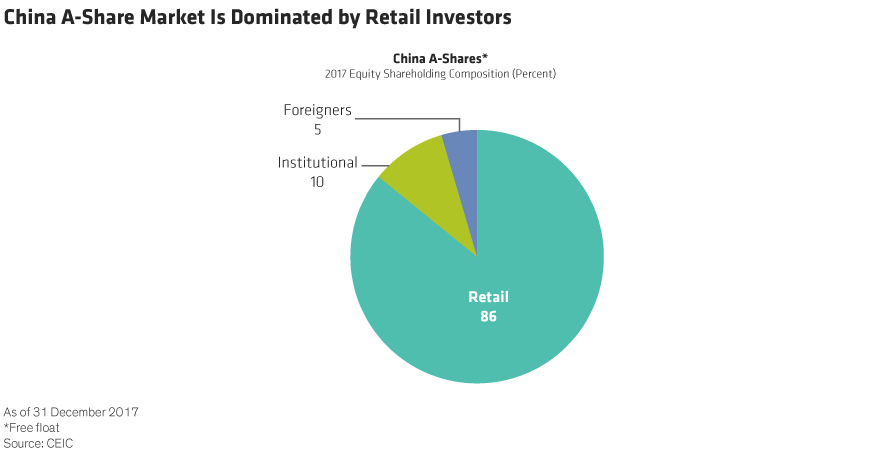

The China stock market is highly volatile despite being one of the largest and most liquid markets in the world. One of the main reasons for the highly volatility of the market is the dominance of retail investors. Unlike the US or other major markets, retail investors and not institutional investors are the largest investors in the Chinese domestic market. Compared to institutions retail investors tend to be short-term traders and panic very easily during violent declines or get euphoric during soaring markets.

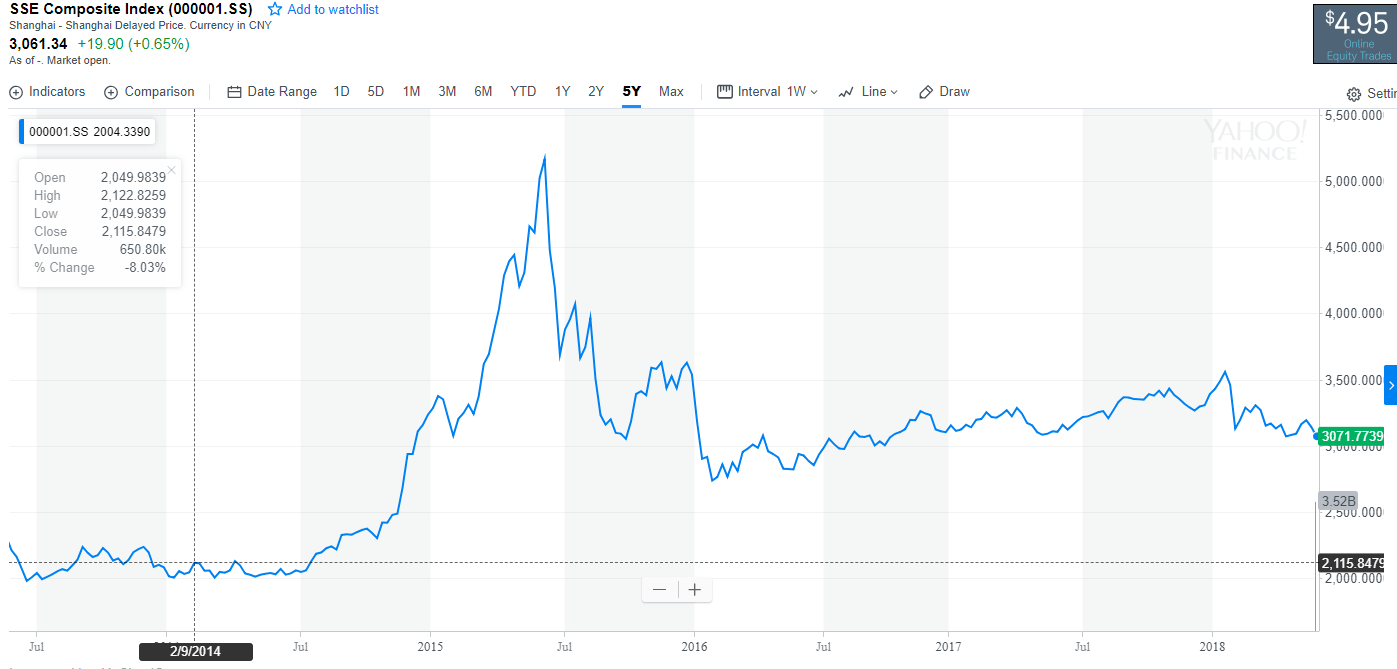

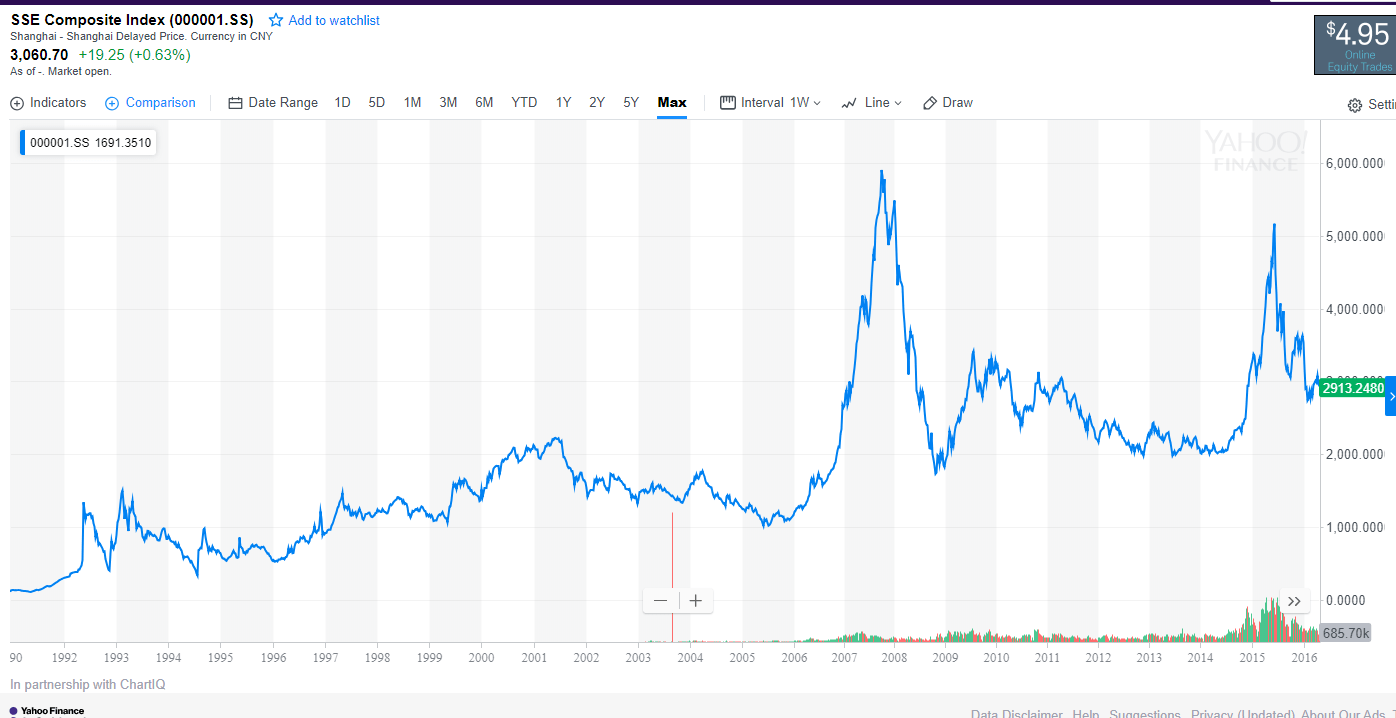

The following charts show the volatility of China’s equity markets:

Shanghai Composite Index Returns -5 Years

Shanghai Composite Index Returns-Long Term:

Source: Yahoo Finance

From an article at Alliance Bernstein:

Click to enlarge

Chinese Retail Investors Have Short Time Horizons

Chinese retail investors’ trading habits are fickle; they tend to act on news headlines and short-term developments rather than long-term forecasts. Even onshore mutual fund managers tend to behave like headline-chasing retail investors, because Chinese portfolio managers are typically incentivized to chase short-term performance.

Source: Will China Export Volatility as Equity Markets Open?, Alliance Bernstein

Related: