Frontier market stocks have soared so far this year. Compared to emerging and developed markets the performance of frontier market stocks is exceptionally good year-to-date(YTD). As of Aug 6th, the MSCI Frontier Market Index increased by 19% YTD while the MSCI indices for Emerging and Developed Markets were up by only 6% and 2.2% respectively.

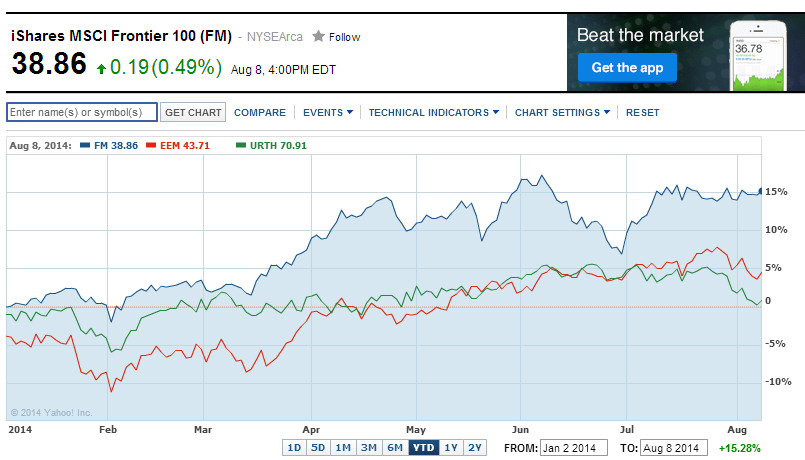

The chart below shows the performance of three iShares ETFs which can be considered as proxies for these markets:

Click to enlarge

Source: Yahoo Finance

The iShares MSCI Frontier 100 ETF (FM)shown in in blue above tracks the performance of the MSCI Frontier Markets 100 Index. This index is comprised of the 100 of the largest and most liquid constituents of the MSCI Frontier Markets index. Last year the MSCI Frontier Markets 100 Index was up by over 26%. In terms of country breakdown, Argentina, Kuwait,Nigeria,Qatar and UAE account for about 70% of this index. Financials amount to nearly 55% of the sector weightings in the index. The iShares Emerging markets ETF (EEM) and the iShares MSCI World ETF(URTH) are shown in red and green respectively.

On the individual country level many of the equity markets are up by double digits YTD. The YTD returns of some of the frontier markets are listed below:

Argentina: 52.6%

Egypt: 34.9%

Sri Lanka: 17.0%

Pakistan: 16.3%

Thailand: 17.1%

Source: The Wall Street Journal

From a recent article in the journal:

The attraction to these rapidly growing markets has been widespread. In June, Norway’s $886 billion sovereign-wealth fund, the largest in the world, jumped on the bandwagon toadd frontier markets to its investments.

The problem for many investors is that the opportunities in frontier markets are few and competition is fierce. Foreign ownership of many companies in the index has reached government limits already.

Ten stocks account for more than 35% of the MSCI Frontier index, according to MSCI data, and companies in Kuwait constitute nearly one-quarter of the overall index’s market capitalization. Nigeria accounts for one-fifth.

The total market capitalization of all stocks included in the MSCI Frontier Markets index is $109 billion, according to MSCI, compared with $4 trillion in the equivalent emerging-market index. Given the markets’ size, some investors worry about a potential, sudden race for the exits. With thin liquidity, executing sales quickly could drive frontier markets sharply lower, if buyers could be found at all, they say.

Fund managers say part of the reason frontier markets appear to have performed so well this year that some countries have been reclassified. Qatar and the United Arab Emirates were considered strong enough to be upgraded to emerging status in June, shrinking the realm of frontier markets and concentrating the flow of foreign cash into fewer countries.

Source: Frontier Boom Pushes Boundaries, Aug 7, 2014, The Wall Street Journal

Index provider MSCI upgraded Qatar and the United Arab Emirates to emerging market status as of May 30. So moving forward these countries will be removed from ETFs that mirror the MSCI index.

Despite the dramatic of frontier market equities investors need to be cautious about investing in these markets. Some of the risks of frontier markets include:

- Political risk is a major factor in these countries. Political chaos and changes can occur almost overnight. During the 2011 revolution in Egypt, the benchmark index plunged and the market was closed for 8 weeks.

- Stocks in frontier market exchanges can be highly illiquid. Very few percentage of the population participates in the equity market and hence trading volumes may be very tiny compared to the developed world markets. In times of market meltdowns there may not be a way out even if ones to sell their holdings.

- Frontier markets in general are small in terms of market capitalization relative to emerging and developed markets. For example,

- the total market capitalization of Vietnam’s stock market reached about $52.0 billion last month. This figure may be high for a country like Vietnam, but the market capitalization of many developed market exchanges are in the billions or even Trillions. The market capitalization of all stocks listed on the New York Stock Exchange exceeded 17.0 Trllions at the end of this year according to the World Federation of Exchanges.

- Foreign investor participation in such markets is a double-edged sword. Because of high foreign investment these markets can soar but they can also fall hard when they pull out their investments. Since these markets are small a sudden flow of foreign capital can lead to major falls in equity prices.

Frontier markets, as the name implies, is still the wild west of the investing world. Hence investors should only allocate a tiny portion of their portfolio to such markets. In addition, it is better to invest in individual companies. Any investments should be made via an ETF or a mutual fund.

Disclosure: No Positions