The U.S. dollar has been the world’s preferred reserve currency since the end of World War I. The fact that about 60% of the world’s foreign exchange reserves are held in U.S. dollars proves that the world continues to maintain the faith in the dollar.

The U.S. is a debtor country. The government borrows heavily from both the domestic public and foreigners in order to fund its expenses. In fact as of Jan 6, 2014 the total public debt outstanding is $17,310,216,315,568.94 with the debt held by the public at $12,333,870,746,301.06 and the rest as intragovernmental holdings according to the U.S. Department of the Treasury.

Foreigners hold about $5.6 Trillion of U.S. debt as of Oct 2013. China is the largest creditor to the U.S. holding about $1.3 Trillion of US debt.

From The Absolute Return Letter, Nov 2013 by Niels C. Jensen of Absolute Return Partners LLP:

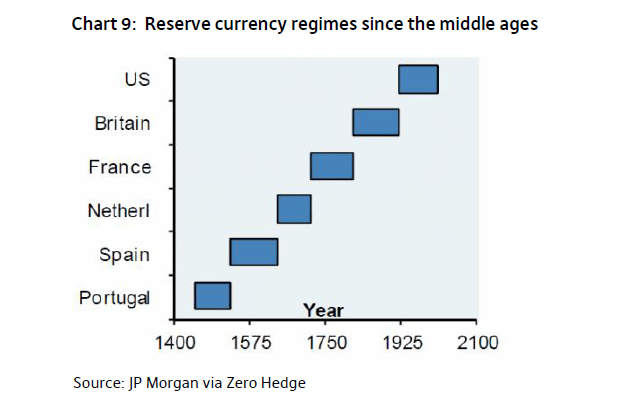

The Americans seem to take their status for granted. Perhaps they need a reminder that reserve currency regimes come and go (chart 9). Given its status as a large debtor nation with insufficient domestic savings to finance its deficits internally, it could prove very painful, should the rest of the world decide that it is time for a change. The longer QE goes on for, the more likely that is to happen.

Click to enlarge

Source: Euthanasia of the economy?, The Absolute Return Letter, Nov 2013, Absolute Return Partners LLP

Despite being a large debtor country I believe it is highly unlikely that the dollar would lose its reserve currency status anytime soon. However we can think of some scenarios where the dollar could go from the world’s most preferred currency to a normal currency or even a worthless currency. Some of the scenarios which can make the U.S. dollar lose its coveted reserve currency status include the world losing faith in Uncle Sam for whatever the reason, China asking the debtor to repay its loans in full, social unrest, political chaos, etc.