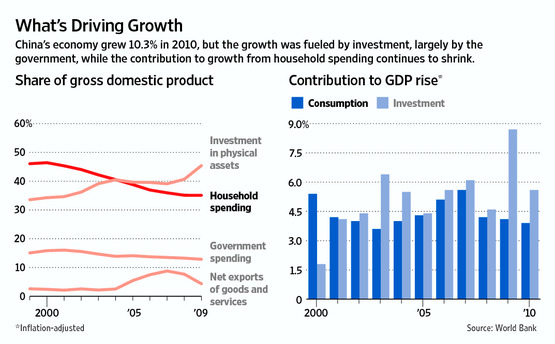

Consumer spending accounts for over 70% of the U.S. economy.China on the other hand is not a consumer-driven economy. Despite the tremendous growth in recent years, consumer spending is relatively less in China. Much of the growth reported by China comes from investment spending rather than consumption spending.

Source: The Wall Street Journal

The chart above shows that household’s contribution to China’s GDP has been shrinking since 2008. Consumer spending accounts for just 35% of the China’s GDP – about half the level of the U.S. Hence from an investment standpoint the takeaway is that investors must focus on companies that are involved in the infrastructure space instead of firms catering to consumer demands such as retailers, fast-food chains, etc. Some of the foreign firms helping China build its infrastructure include ABB (ABB), General Electric (GE), Siemens (SI), Areva (ARVCY), etc.

Disclosure: No positions