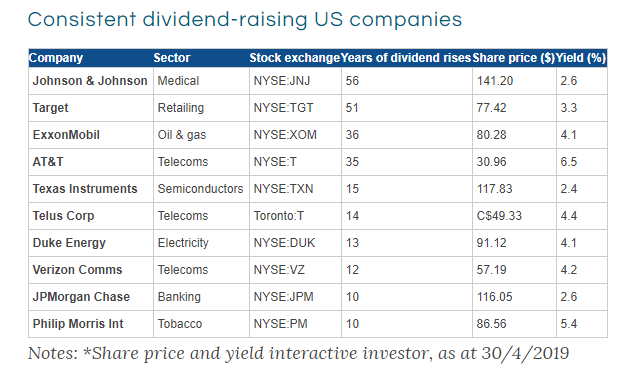

When investing in stocks it is important to consider if a company is paying a dividend or not. Dividend payers are relatively safer than non-dividend payers. Well established and profitable firms usually pay a dividend. Unlike other numbers that can easily be manipulated using financial magic dividends usually come out of profits are hard to fudge. While many companies pay dividends, those that raise it year after year are even better for the long-term. Dividend raisers are cream of the crop. Not all firms that pay out dividends can manage to increase them consistently over many years.So investors looking for relatively stable growth with decent yields have to seriously consider adding consistent dividend raisers. With that said, the following table shows 10 dividend raising companies with 9 of them from the US and 1 from Canada.

Click to enlarge

Source: International share swaps: 12 alternatives to UK shares, Money Observer

Of the stocks listed above, Johnson & Johnson (JNJ) has increased dividend 56 years, a truly great achievement to say the least. Other such as Verizon(VZ), AT&T (T), Exxon Mobile(XOM), etc. are also excellent blue chip stocks that deliver above average yields to investors consistently. Canadian telecom giant(TU) is also a good choice.

Disclosure: No Positions