European equities are currently at a discount to their US peers.In the past, whenever this scenario occurred European stocks have played catch and have eliminated this discount as investors gobbled up shares that were undervalued. However that is not the case in the past few years.European stocks continue -to lag US stocks for a number of reasons. Even though the EU is a single market, each individual country has its own issues including political and economic problems. For example, up until a while ago sovereign risks dominated the headlines with countries like Greece on the verge of economic collapse.That risk declined after multi-year multiple bailouts. It seemed like Europe was finally getting back on track. But then the usually calm UK erupted in chaos with the Brexit vote.Today banking issues in Germany and Italy have come to the forefront of economic issues facing the continent. With all the never-ending issues it seems like it will take a few decades or even a century for Europeans to solve their issues.

According to a report by Schroder’s political risk is weighing heavily on European stocks and as a result investors are demanding a bigger discount. In addition to the political risks, other issues like banking industry problems and deflationary risks are well known and are already priced in. It is indeed surprising that political risk usually identified with emerging and frontier markets is the major risk facing the European markets today. One factor that differentiates emerging and frontier basket-case countries from Europe is that political issues in Europe will be solved peacefully and is unlikely to lead to political revolution or a military takeover of a country. For instance, countries like Egypt or Thailand have gone from democratic to dictatorship or military almost overnight. This type of radical change will not occur in Germany or France or any other European nation. So pressure of political risks hanging over European stocks will eventually go away and they will recover to catch up with their American counterparts.

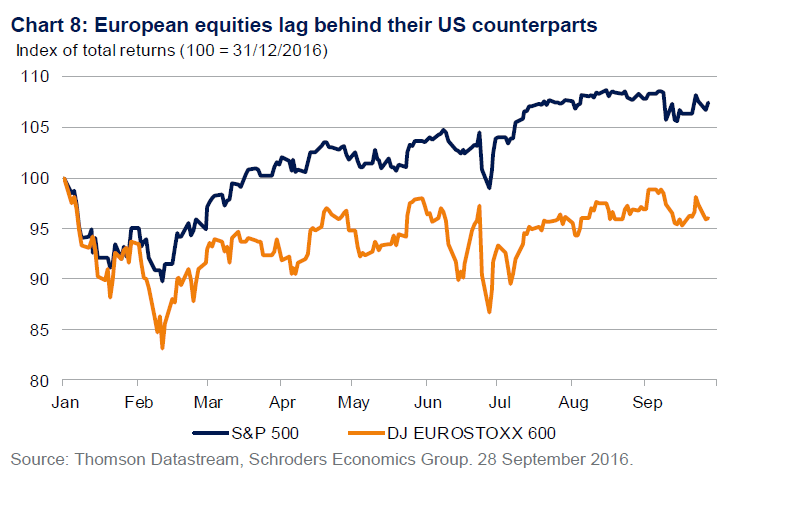

The following chart shows European stocks are lagging their US peers:

Click to enlarge

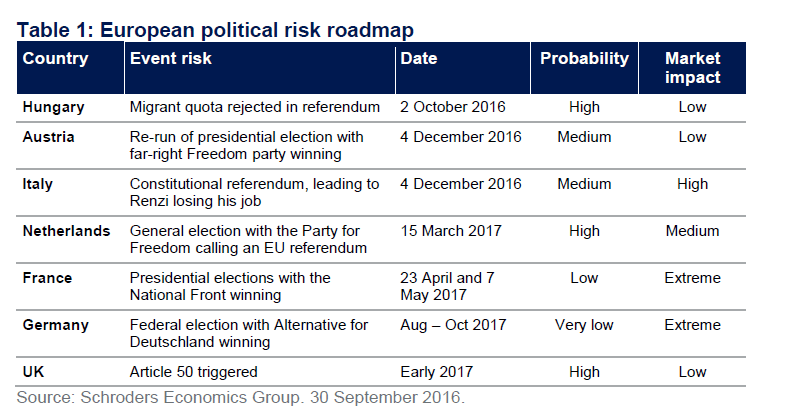

The table below lists seven political events that pose adverse risk to equity markets:

Source: Schroders Economic and Strategy Viewpoint, Oct 2016, Schroders

Investors looking to take advantage of the current discount can consider the following stocks for further research:

- Banking: ING Group (ING) – Buy with both hands under $10 per share, Nordea Bank (NRBAY), Svenska Handelsbanken AB (SVNLY)

- Industrials: Siemens (SIEGY)

- Chemicals: b BASF AG(BASFY), Arkema(ARKAY)

- Auto-parts: Valeo (VLEEY), Continental AG(CTTAY)

- Consumer staples: Nestle(NSRGY), Unilever (UL)

- Oil: Total(TOT), Royal Dutch Shell (RDS-A) and Eni Spa (E)

A simpler and easier way to invest in major European firms is via ETFs. Two ETFs that fit the bill are SPDR EURO STOXX 50 ETF (FEZ) and SPDR STOXX Europe 50 ETF (FEU).

Disclosure: Long ING, CTTAY