“I’ll tell you why I like the cigarette business. It cost a penny to make. Sell it for a dollar. It’s addictive. And there’s a fantastic brand loyalty.” – Warren Buffet

Page Updated: 4/7/19

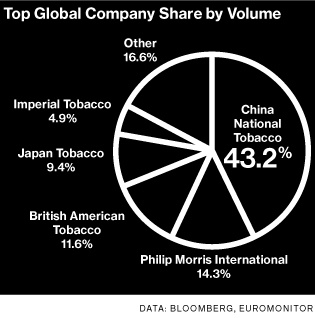

The tobacco industry sells about six trillion cigarettes each year. The industry is highly concentrated with a handful of firms controlling the majority of the global tobacco market. The tobacco market was worth about $614 billion in 2009.China is the biggest market based on total cigarettes consumed. There are some 350 million smokers in China who consume around 2,200 billion cigarettes a year, or about 41% of the global total. However the industry in China is state-owned by the monopolistic China National Tobacco Company.

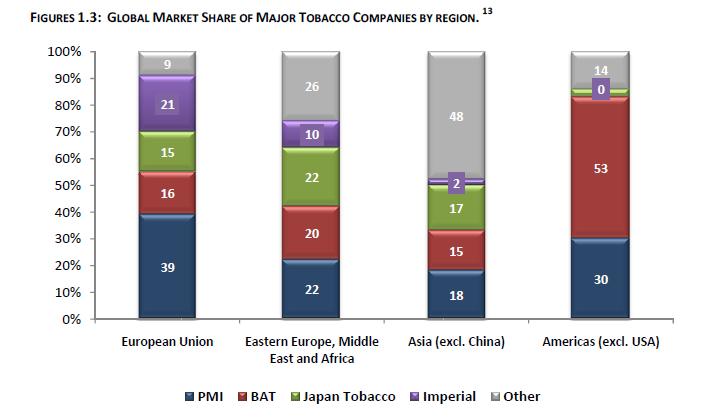

Outside of China, the four largest publicly-listed international tobacco companies account for about 46% of the global market according to British American Tobacco (BTI).

Philip Morris International is US-based and BAT and Imperial Tobacco are based in the UK.Companies that operate mainly in the domestic markets include Egypt’s Eastern Tobacco, Thailand’s Tobacco Monopoly, Bulgaria’s Bulgartabak, Taiwan’s Tobacco & Liquor Corp and Vietnam’s National Tobacco Corporation. The major American players in the U.S. market are Altria(MO), Vector Group Ltd (VGR) and Turning Point Brands, Inc.(TPB).

Based on the total number of cigarettes sold, the top five global brands are Marlboro, Winston, Mild Seven, L &M and Kent.

After China, the ten countries that consume the largest number of cigarettes are Russia, the U.S., Japan, Indonesia, India, Brazil, Ukraine, Turkey, Korea and Italy. The relationship between volume of cigarettes sold and volume of profits shipped are not consistent across markets. For example, Phillip Morris International’s sales in OECD countries accounts for one-third of total sales but accounts for 46% of total profits. And the tow-third of sales in non-OECD nations account for only 54% of its profits.

Due to their scope and scale of profits, tobacco companies transfer huge amounts of wealth from one region of the world to another. In 2008, around $20 billion was earned by tobacco companies from outside their home territories.

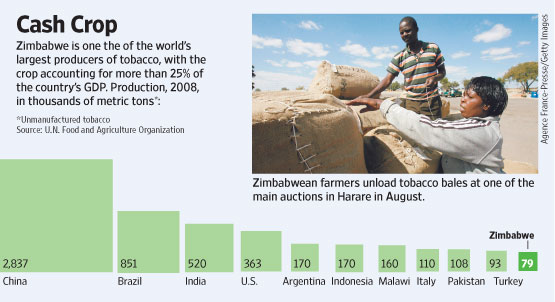

The Top tobacco growing countries are shown in the graphic below:

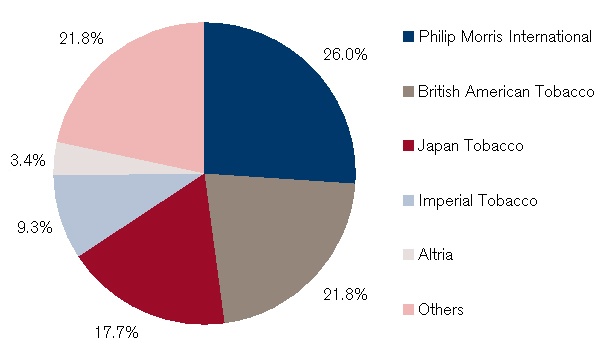

- Phillip Morris International (PMI), which was spun off from Altria in 2008 is the world’s largest private tobacco company. Altria sells its products in the US market while PHI sells them overseas. With 75,000 employees Philip Morris owns seven of the leading 15 global brands. In 2008, the company reported revenues of over $64 billion. PM repatriates about $10 billion in profits to the US from global sales.

- British American Tobacco(BTI) is the second largest tobacco company in the world based on unit volume.The company’s 2008 revenue totaled about $50 billion. Some of the top brands owned by BAT include Dunhill, Pall Mall, Lucky Strike, Viceroy and Vogue. BAT also holds substantial stakes in Reynolds American and Indian Tobacco Company (ITC) of India. In terms of ownership, more than two-fifth of the shares are held by just 400 shareholders including the Canada Pension Plan Investment board. BAT repatriates about $6 billion from overseas earnings to UK. More than three-fourths of the company’s sales are in the fast growing emerging markets.

- UK-based Imperial Tobacco(ITYBY) also sells the majority of cigarettes outside of UK. The company repatriates about $4 billion in earnings to UK from abroad.

- Altria (MO), formerly known as Philip Morris, is the largest cigarette maker in the US. Reynolds America (RAI) ranks the second followed by Lorriard.

- Stockholm, Sweden-based Swedish Match(SMWAY) is involved in the production and sales of snuff and snus, chewing tobacco, cigars and pipe tobacco.The company does not make cigarettes and the “match” component makes up only 10% of its revenues.

In addition to shareholders, one of the biggest beneficiaries of sales of tobacco are the governments of various countries. Governments worldwide generated over $160 billion in the form of excise taxes, duties, income taxes, etc. from just nine companies in 2008.

Current and Future State of the industry:

Cigarette smoking is declining in the developed world due to unprecedented bans on cigarette usage in public places, restrictions on advertising, extremely high taxes, health warnings, limitations on retail display and other factors. In addition, the percentage of population who are smokers is reducing. As a result consumers in developed countries are switching to lower-priced offerings and alternatives to cigarettes such as smokeless tobacco, snus, etc.

While sales is declining in developed countries it is booming in emerging markets. Tobacco makers are aggressively marketing in those markets in order to compensate for the declining sales in rich countries. However even in emerging markets governments are proposing tougher regulations governing the sales and marketing of tobacco products.

From an article in the New York Times:

This year, Philip Morris International sued the government of Uruguay, saying its tobacco regulations were excessive. World Health Organization officials say the suit represents an effort by the industry to intimidate the country, as well as other nations attending the conference, that are considering strict marketing requirements for tobacco.

Uruguay’s groundbreaking law mandates that health warnings cover 80 percent of cigarette packages. It also limits each brand, like Marlboro, to one package design, so that alternate designs don’t mislead smokers into believing the products inside are less harmful.

The lawsuit against Uruguay, filed at a World Bank affiliate in Washington, seeks unspecified damages for lost profits.

They are using litigation to threaten low- and middle-income countries, says Dr. Douglas Bettcher, head of the W.H.O.’s Tobacco Free Initiative. Uruguay’s gross domestic profit is half the size of the company’s $66 billion in annual sales.

Peter Nixon, a vice president and spokesman for Philip Morris International, said the company was complying with every nation’s marketing laws while selling a lawful product for adult consumers.

He said the company’s lawsuits were intended to combat what it felt were excessive regulations, and to protect its trademark and commercial property rights.

Cigarette companies are aggressively recruiting new customers in developing nations, Dr. Bettcher said, to replace those who are quitting or dying in the United States and Europe, where smoking rates have fallen precipitously. Worldwide cigarette sales are rising 2 percent a year.

But the number of countries adopting tougher rules, as well as the global treaty, underscore the breadth of the battleground between tobacco and public health interests in legal and political arenas from Latin America to Africa to Asia.

The cigarette companies work together to fight some strict policies and go their separate ways on others. For instance, Philip Morris USA, a division of Altria Group, helped negotiate and supported the anti-smoking legislation passed by Congress last year and did not join a lawsuit filed by R. J. Reynolds, Lorillard and other tobacco companies against the Food and Drug Administration. So far, it is not protesting the agency’s new rules, proposed last week, requiring graphic images with health warnings on cigarette packs.

But Philip Morris International, the separate company spun out of Altria in 2008 to expand the company’s presence in foreign markets, has been especially aggressive in fighting new restrictions overseas.

It has not only sued Uruguay, but also Brazil, arguing that images the government wants to put on cigarette packages do not accurately depict the health effects of smoking and vilify tobacco companies. The pictures depict more grotesque health effects than the smaller labels recommended in the United States, including one showing a fetus with the warning that smoking can cause spontaneous abortion.

In Ireland and Norway, Philip Morris subsidiaries are suing over prohibitions on store displays.

In Australia, where the government announced a plan that would require cigarettes to be in plain brown or white packaging to make them less attractive to buyers, a Philip Morris official directed an opposition media campaign during the federal elections last summer, according to documents obtained by an Australian television program, and later obtained by The New York Times.

Hence similar to other sectors tobacco multinationals are increasingly dependent on emerging markets to maintain earnings. As income levels and standard of living increases in EM countries, sales of tobacco products may increase further. In some ways a bet on tobacco stocks can be considered as a bet on emerging markets.

Currently Altria Group (MO),Philip Morris International (PMI) and Imperial Tobacco Group (ITYBY) pay have dividend yields between 4% to 6% while Swedish Match (SWMAY) and British American Tobacco (BTI) pay between 2% to 3%.

Sources: Euromonitor International, The New York Times, The Wall Street Journal, Company sites, WHO, The Global Tobacco Economy by Physicians for a Smoke-Free Canada.

Tobacco Stocks List:

Related Articles:

- Economic Facts About U.S. Tobacco Production and Use, CDC

- The Tobacco Atlas, World Lung Foundation & American Cancer Society

- Tobacco industry, Wikipedia

- New Tobacco Atlas Estimates U.S. $35 Billion Tobacco Industry Profits and Almost 6 Million Annual Deaths

- Tobacco industry dying? Not so fast, says Stanford expert, Stanford University News

- Tobacco Industry, Guardian, UK

- Tobacco atlas: country by country, Guardian, UK

- Tobacco in Australia, The Cancer Council

- The Tobacco Atlas, WHO

- Tobacco Economics, Allan Gray Asset Managemen

- Philip Morris International Inc, Euromonitor

- Top tobacco producing U.S. states in 2011, Statista

- The Legacy Tobacco Digital Library – Contains more than 14 million documents created by the industry (University of California, San Francisco)

- Top Global Tobacco Companies:

Click to enlarge

Source: Tobacco Industry Set to Grow In Emerging Markets, Credit Suisse

From TobaccoFreeKids.org site:

- Tobacco Economics in Indonesia – Factsheet,

- Tobacco Industry Profile – Indonesia (includes Top Tobacco companies and Brands in Indonesia)

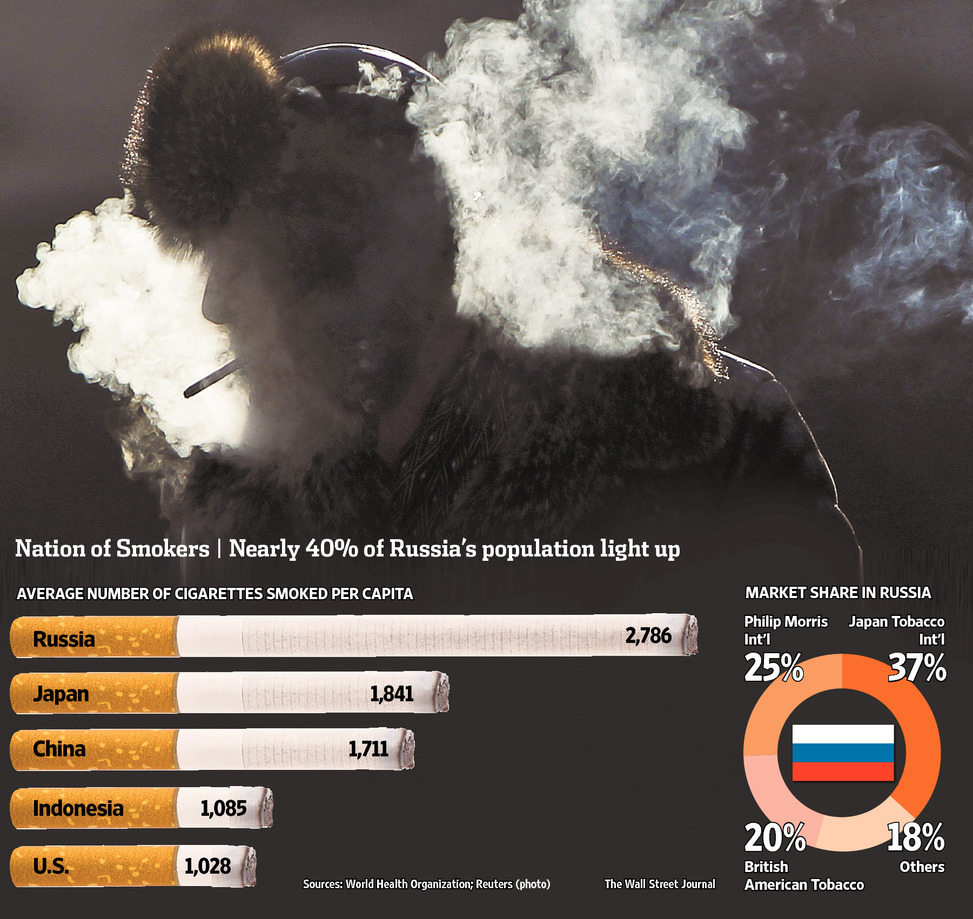

- Tobacco Industry Profile – Russia (includes Top Tobacco companies and Brands in Russia)

- The Economics of Tobacco and Tobacco Taxation in India – Factsheet

- Pictorial Health Warning Galleries by Country (WHO)

- Cigarette Price and Tax Differential in the EU countries, Tobacco Manufacturers’ Association, UK

- 80 Million a Day (Indonesia), ABC News

- The tobacco industry in the United States by Meyer Jacobstein (EBook from Google Books)

- Tobacco Market Share in Russia

Click to enlarge

Source: Kremlin Cracks Down on Big Tobacco, WSJ

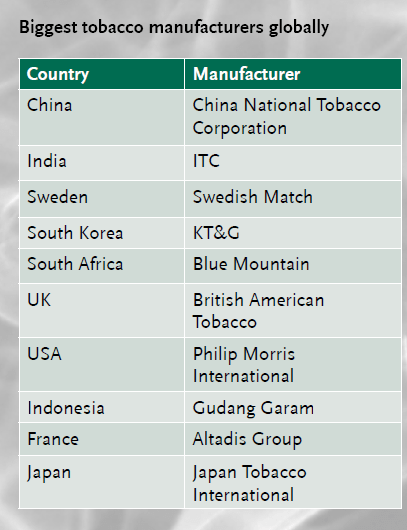

Biggest Global Tobacco Makers:

Source: The Global Tobacco Industry (Click to download the pdf report), Mazars

- Report: Health Insurers Hold Billions in Tobacco Stocks, Democracy Now

- The Complete list of Tobacco stocks trading on the NYSE

- Addicted to Profit: Big Tobacco’s Expanding Global Reach (Talking on Tobacco)

- THE TOBACCO TIMELINE – (History of Tobacco) from Tobacco.org

- How Philip Morris unlocked the Japanese cigarette market: lessons for global tobacco control, June 2004, British Medical Journal

- The World’s Leading Tobacco Companies, 2008 (Chart)

- US Tobacco Companies list as of 2008 (pdf)

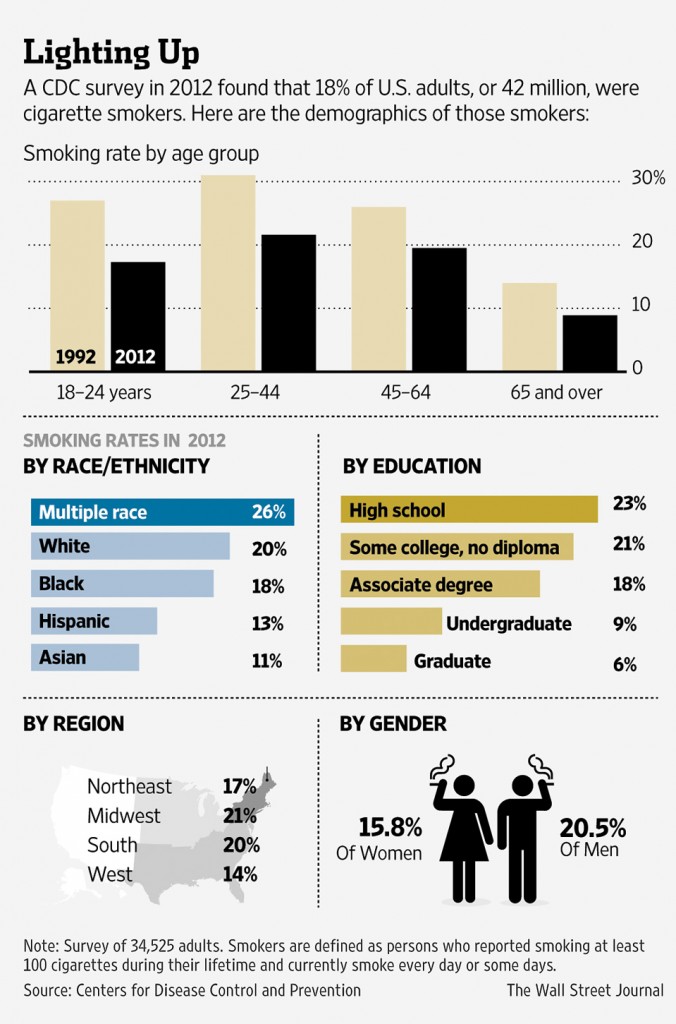

Source: America’s Smokers: Still 40 Million Strong, The Wall Street Journal, July 16, 2014

World’s Top Tobacco Companies 2014 (Bloomberg Industry Market Leaders)

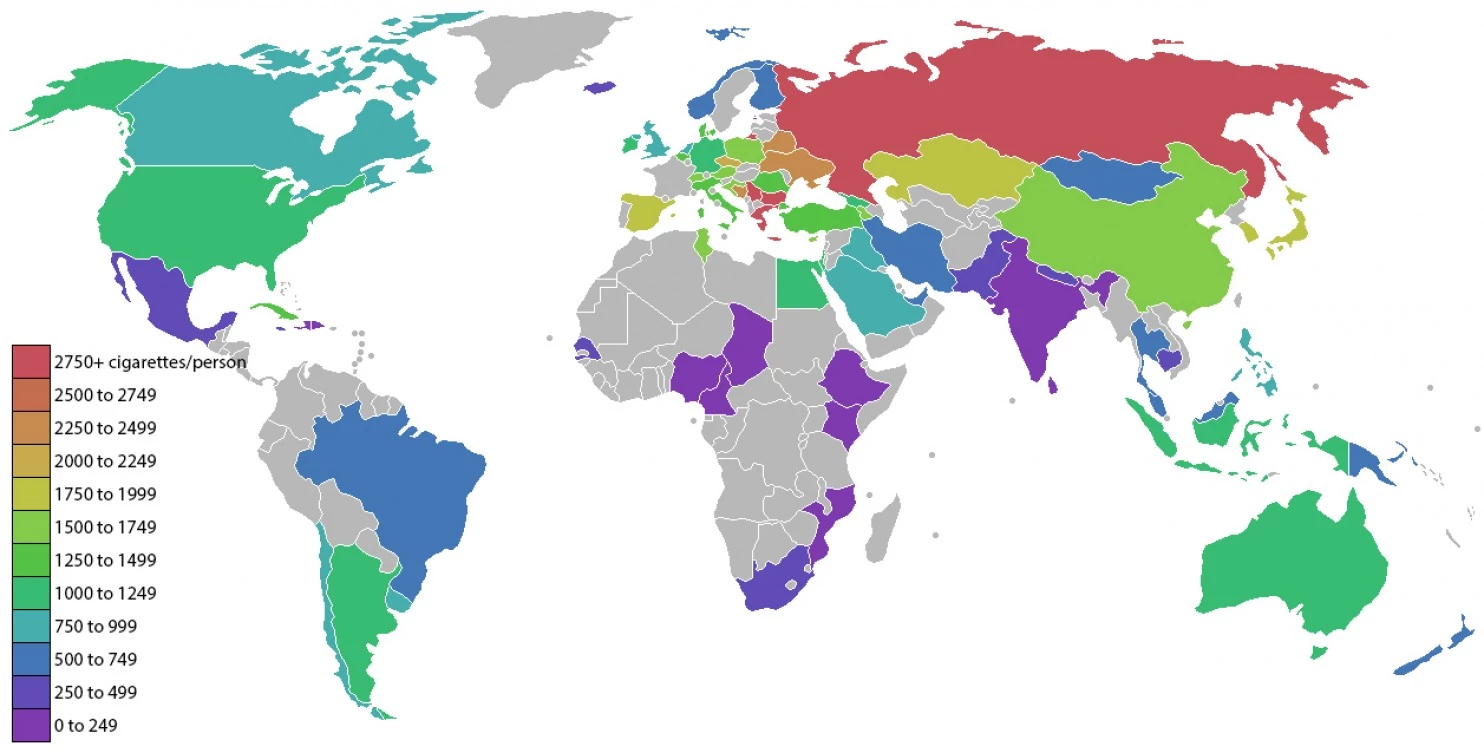

Where people smoke the most (and least) cigarettes per person:

Source: 40 maps that explain the world, The Washington Post, Aug 12, 2013

- Statistics and facts about the tobacco industry

- Market research for the tobacco industry

- The battle for control of the cigarette packet (Nov 2014, BBC)

- THE GLOBAL CIGARETTE INDUSTRY (Tobacco Free Kids, Aug 2014)

- The global tobacco manufacturing industry (Tobacco in Australia)

- The globalization of tobacco use: 21 challenges for the 21st century. (National Center for Biotechnology Information, U.S. National Library of Medicine)

- Tobacco Industry in the UK (Ash, Aug 2014)

- An overview – The Global Tobacco Industry (Mazars)

- The Political Mapping of China’s Tobacco Industry and Anti-Smoking Campaign (The Brookings Institution)

- Smoking & Tobacco Use – Data and Statistics (CDC)

- Fifty Years of Smoking in Two Charts (Bloomberg BusinessWeek, Jan 17, 2014)

- The Chinese Government Is Getting Rich Selling Cigarettes (Bloomberg BusinessWeek, Dec 11, 2014)

- FDA to Propose Ban of Menthol Cigarettes, WSJ, Nov 9, 2018

- “The poor, the young, the black and the stupid”: Inside Big Tobacco’s plans to kill a billion people (Pando)

- Tobacco: A deadly business

Revealed: the free-market groups helping the tobacco industry (The Guardian, Jan 23, 2019) - Tobacco industry (Wikipedia)

- Tobacco industry (The Guardian)

- A brief overview of the tobacco industry in the last 20 years (BMJ)

- Tobacco Explained – The truth about the tobacco industry …in its own words (WHO)

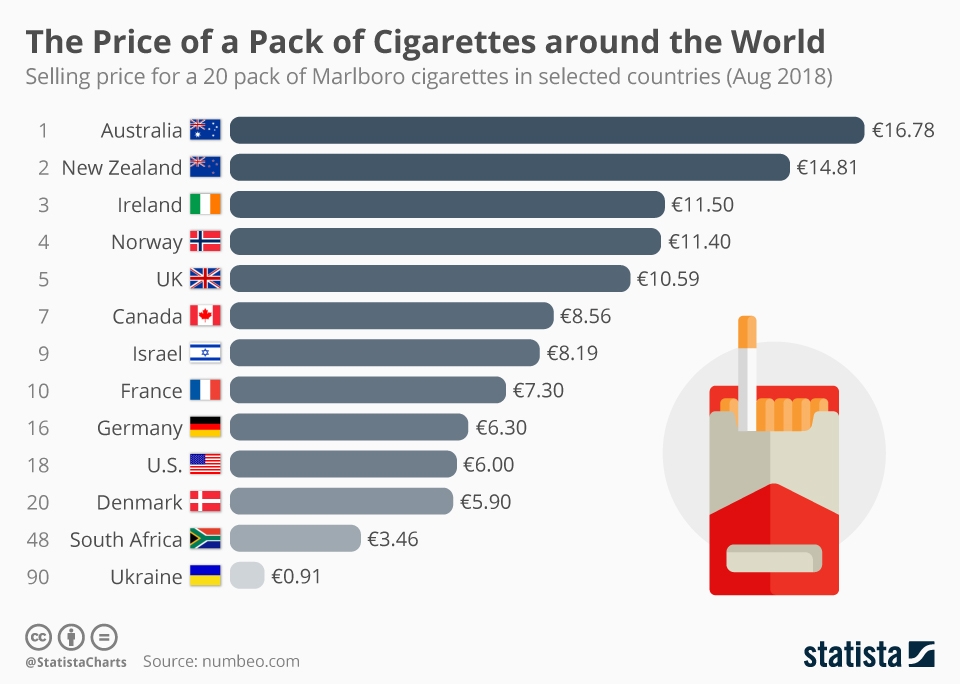

- The Price of a Pack of Cigarettes around the World – 2018

Click to enlarge

Source: Statista

nice primer into the tobacco game

Very nice overview of the industry

Interesting overview of the industry. Where can I fins full references?

Emelie

You can check on the links within the article for reference.

Thanks

-David

Excellent overview

Fantastic overview of the industry. Thank you for sharing!

Thanks for the comment Dave.Glad you liked this post.