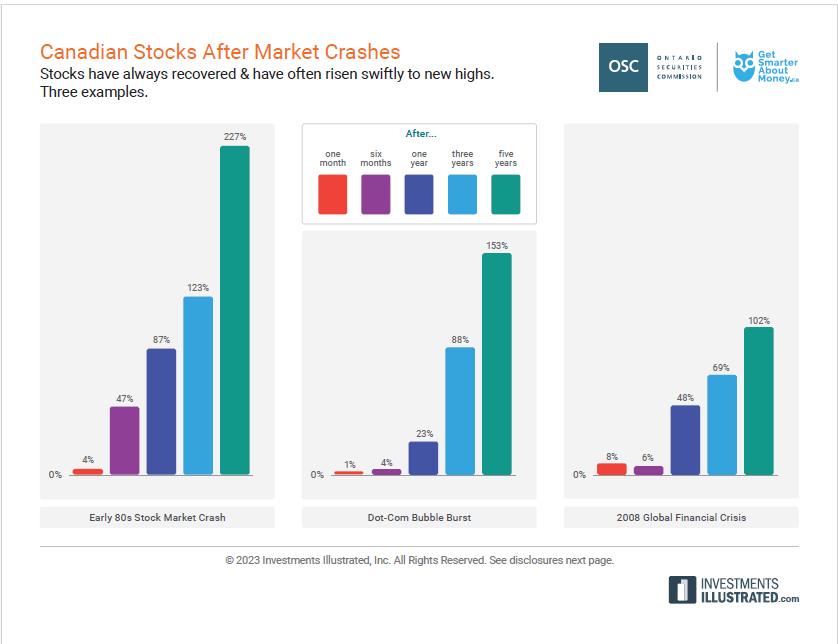

Mining is critical to the province of Ontario in Canada. According to Ontario Mining Association, mining contributed over C$8.0 billion to GDP in 2021. The industry employed about 31,000 workers in direct employment. Many other interesting facts about the industry are in the above link.

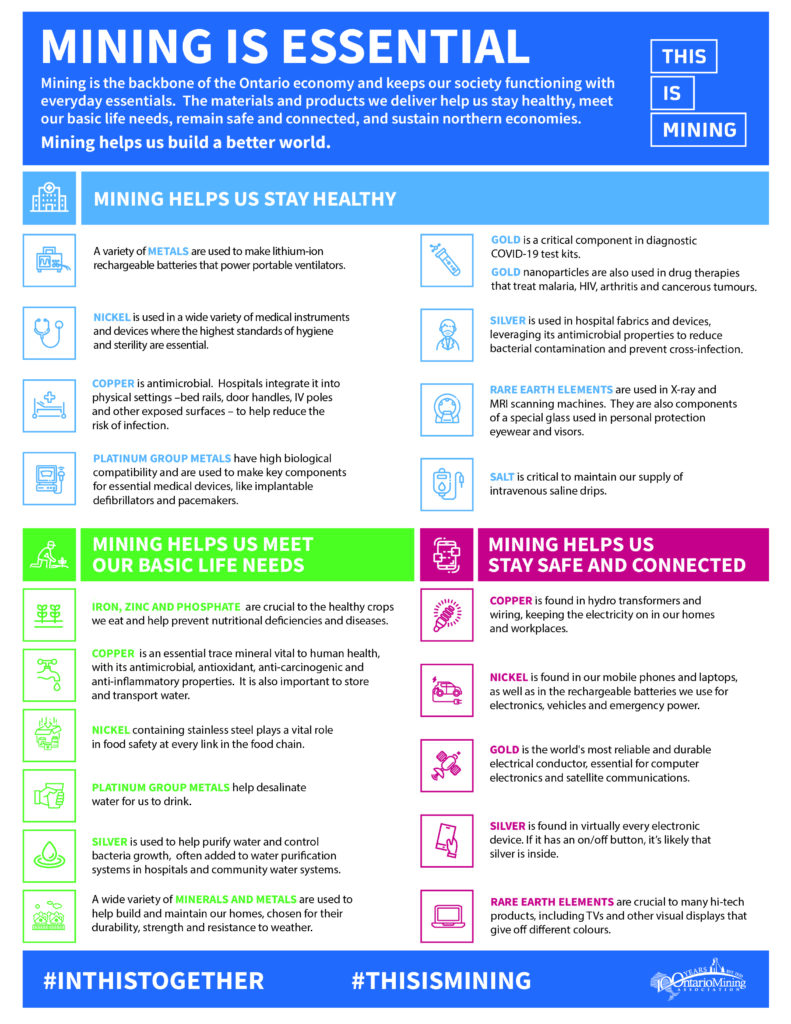

In addition to the economic benefits, the mining of metals and minerals is also important for the well-being of the people not only in the province but also everyone around the world. I came across the following infographic showing how various metals are used in everyday items and functioning of our society. For example, who knew gold was a critical component in Covid-19 test kits.

Click to enlarge

Source: Ontario Mining Association

Related ETF:

- SPDR Gold Trust (GLD)

Disclosure: No positions