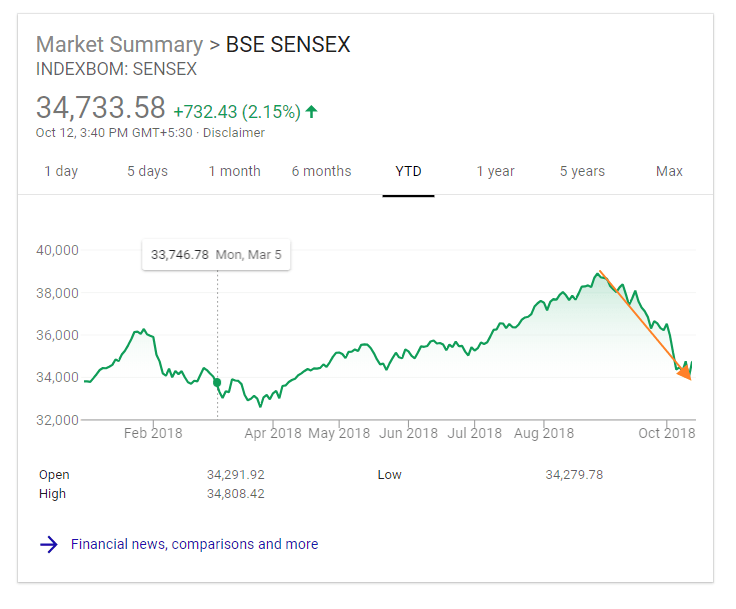

The benchmark index of the Indian equity market S & P BSE Sensex is up by 2% YTD at 34808. However over the past 52 weeks it reached a record high of 38896. Since then it has slid some 5% to current levels. Among the major emerging markets, only Brazil is performing better than India due to ending of political uncertainty. Despite the Sensex yielding positive returns so far this year investors need to be cautious with Indian equities. Some of the factors that are not favorable to Indian markets include: rising crude oil prices, record low depreciation of the Indian Rupee against the US dollar, lack of meaningful economic reforms, rising external debt, lackluster corporate earnings, etc. In addition, the Sensex is driven a handful of powerful firms that do not truly represent the state of the economy.

The chart shows the YTD return of the Sensex:

Source: Google Finance

Related: