Brent crude for December 2018 delivery closed at over $84 on Friday. Oil prices have soared in the past year and continue to power higher. Supply issues in Venezuela and Iran are also adding further pressure on oil prices. U.S. sanctions on Iran will take effect on November 5, 3018 which will have more impact on global prices.

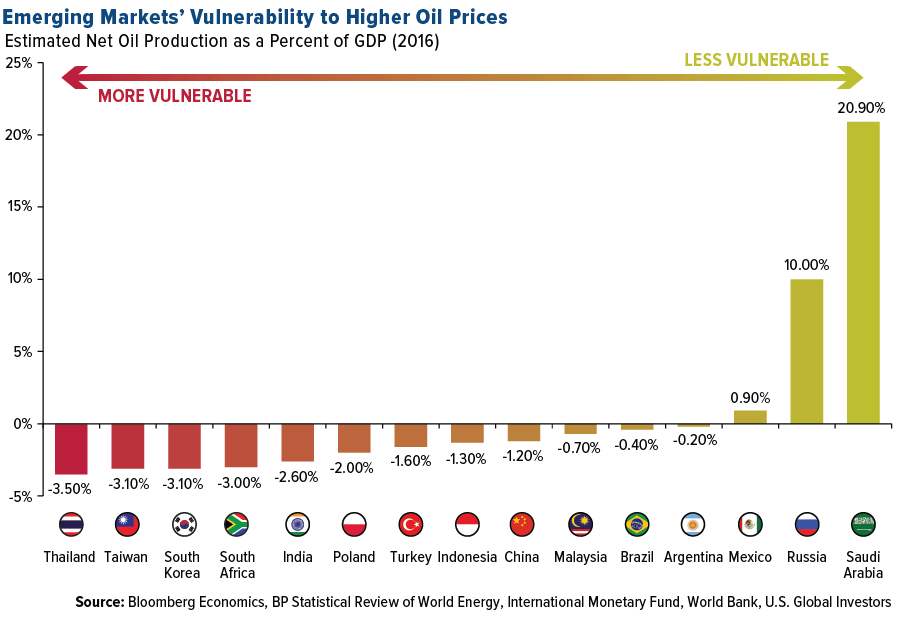

Rising oil prices have a substantial impact on emerging markets with some countries affected more than others. Countries that are net importers will be impacted adversely while oil export countries stand to benefit from higher prices. For example, if oil prices reach $100 a barrel oil exporters will earn higher revenue for the same amount of oil produced and exported. According to Bloomberg, Saudi Arabia, Mexico and Russia are poised to benefit. Oil importing countries such as South Africa, South Korea, India and Thailand will be negatively impacted by rising oil prices.

Click to enlarge

Source: Bloomberg via We Could See $100 Oil Again Soon, But Not for the Reason You Think, U.S. Funds