Oil prices have soared in the past year gaining around 40%. With the summer travel season coming soon drivers in the US can be expected to drive higher demand for gasoline in coming months. Despite the dramatic and surprising boom in oil prices energy and related sector stocks have not kept up up until now. According to Brad Sorensen at Charles Schwab, investors willing to take higher risks can add positions at current levels for higher potential returns but the sector is volatile and hence investors need to be aware of the risks involved.

From the article:

The more things change …

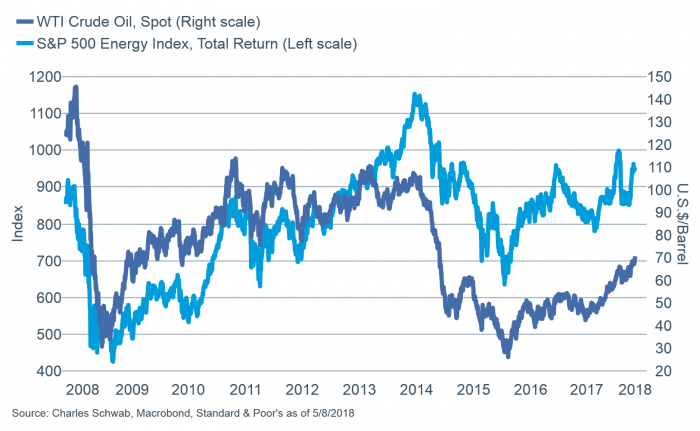

Oil prices have staged a solid rally over the past year, with WTI crude moving from around $50/barrel a year ago to close to $70/barrel currently—a roughly 40% gain. However, as you can see below, the energy sector hadn’t kept up with the commodity gains until a very recent move higher.

The energy sector hasn’t kept up with crude prices.

Past performance is no guarantee of future results

Now that the sector has started to move higher, the potential for the gap to close has excited much of Wall Street, with more bullish calls coming out for both the sector and for oil. The gap, however, could be closed by oil coming down to meet the energy sector line, a possibility that seems to be ignored by much of the current analysis, likely largely due to the bullish view on the future of oil prices. Two other charts appear to indicate that in the past, gaps in traditional relationships have been closed more by the commodity price moving to the stock-related price than the other way around. History is no guarantee of future performance, but it does leave open the possibility of a different outcome.

Source: Schwab Sector Views: Drilling Down on Energy, Schwab

From another article at AllianceBernstein on the same topic:

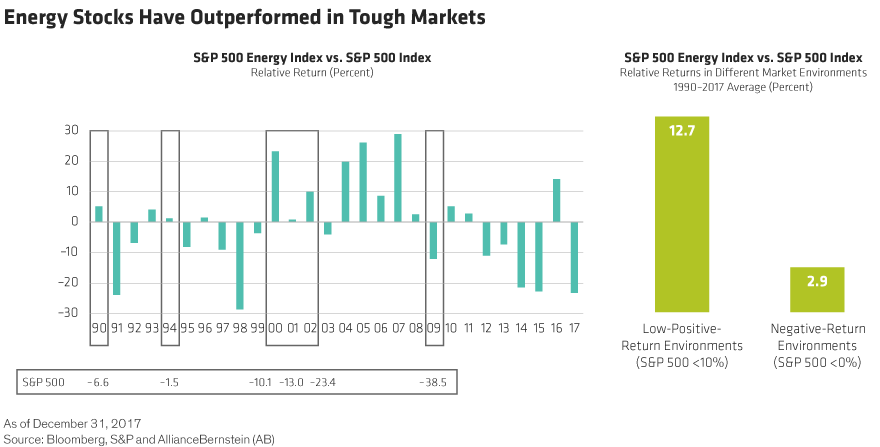

Energy Stocks Have Outperformed Challenged Markets

That might seem counterintuitive, given that energy is often seen as a volatile sector. But in fact, over the past 28 years, energy stocks outperformed challenged markets several times (Display, left): in 1990 and 1994; after the tech bubble burst from 2000 to 2002; and during the global financial crisis in 2008. On average, the energy sector outperformed the S&P 500 by 2.9% in negative-return years and by 12.7% in low-return years (with an S&P 500 price return below 10%), since 1990 (Display, right).

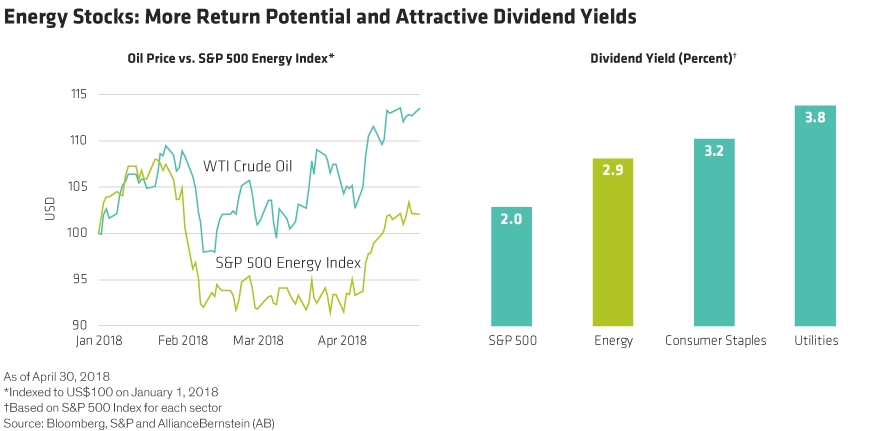

This year, energy stocks have advanced by 2%, outperforming the S&P 500. But they’ve lagged gains in West Texas Intermediate (WTI) crude oil, which has been up 13% (Display). We believe that this disconnect offers an investment opportunity, particularly among integrated oil companies. Within the sector, look for companies with attractive valuations and dividends that rival consumer staples companies, supported by improving fundamentals.

Source: Energy Stocks: A Surprising Defensive Play?, AllianceBernstein

From an investment perspective, energy stocks are not as attractive as they were a few months ago due to the recent run-up. However geo-political issues and demand can lead to higher oil prices in the coming months potentially boosting the stock prices of this sector and related sectors.

In addition to oil majors and oil exploration firms, investors may also want to consider the oil field services and equipment sector firms such as Schlumberger NV (SLB), Halliburton Company (HAL), etc.

Related ETFs:

Disclosure: No Positions