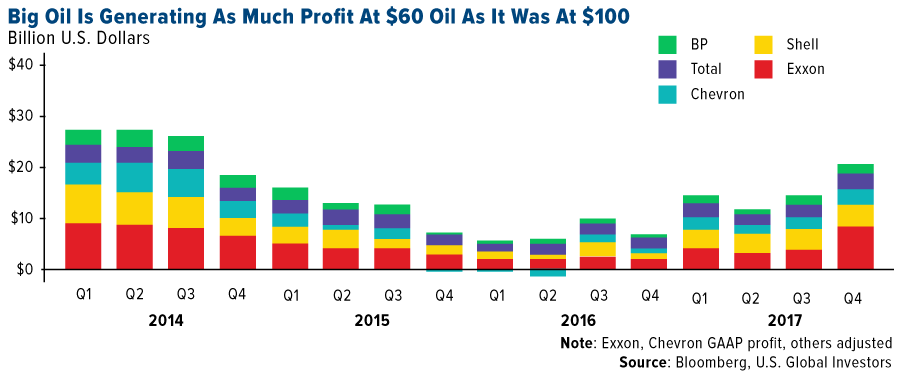

Crude oil prices closed at over $69 for June delivery (Brent). Oil prices have shot up more than 150% since the lows of $26 reached in early 2016.Rising oil prices is helping oil majors earn higher profits. According to an article at U.S. funds, big oil is generating as much profits at $60 as when the price was $100. From the article:

Some resource investors might worry that all this extra supply could depress prices and hurt profits. That’s a valid concern, but it’s worth pointing out that since its recent low of $26 a barrel in February 2016, the oil price has surged nearly 150 percent—all while the number of active wells in North America has risen.

It doesn’t hurt, of course, that demand for petroleum products is just as strong as it’s ever been right now. According to the latest monthly report from the American Petroleum Institute (API), U.S. demand in February reached its highest level since 2007. This was only the third February ever, in fact, that gasoline demand exceeded 9 million barrels a day, reflecting strenthening consumer sentiment and economic growth.

And as I shared with you last month, major explorers and producers’s profits are now in line with what they were when oil was trading for $100 a barrel and more.

According to Bloomberg, the majors are now “prioritizing investors over investments, channeling the extra cash that comes from $60 crude into share buybacks and higher dividends.”

I should add that, besides offering better opportunities for investors, energy independence helps make the U.S., its allies and, indeed, the whole world more secure.

Source: U.S. Energy Is Breaking All Kinds of Records — Are You Participating?, U.S. Funds

Oil majors are rewarding shareholders as earnings rise. For example, French major Total (TOT) announced a 28% increase in profits and a 10% increase in dividends. In addition the firm announced share buybacks as well.

You may also like:

- Infographic: The World’s Ten Biggest Oil and Gas Companies

- Crude Oil Prices Since 1861: Chart

- What is the Long-Term Relationship Between Oil and Stocks?

- The Collapse in Oil Prices is Not an Unprecedented Event

- The Cost of Extraction of Oil by Different Methods

- This Chart Shows Crude Oil Is A Very Volatile Commodity

- S&P Global Platts Top 250 Global Energy Companies 2017 Edition

Disclosure: No Positions